This is my maiden article written in the capacity of Solutions Specialist at Providend highlighting the personal finance aspect in the Singapore Budget 2023. The article was first published on Providend website here:

https://providend.com/singapore-budget-2023-highlights-on-personal-finance/

On 14 February 2023, Deputy Prime Minister and Finance Minister Lawrence Wong gave his Budget Speech “Moving Forward in a New Era” amidst a background of fighting COVID-19 for more than three years, a surprise Ukraine war at the start of 2022, escalating oil and gas prices, a global shortage of food items, and a brutal worldwide inflation reaching historic levels in many advanced economies. Singapore was not spared of such inflationary pressures.

This year’s budget focused on five key areas to deal with inflation and move forward in a new era:

- Enhancing support measures for Singaporeans

- Growing our economy and equipping our workers

- Strengthening our social compact

- Building a resilient nation

- Maintaining a competitive, resilient, and fair tax system

Area 2 is targeting businesses through various funds, credits, and grants for building capabilities, nurturing innovation, dealing with cost pressures, training workers, and enhancing employment support. Area 4 is focusing on building resilience in organisations, the economy, infrastructure, climate, and people in Singapore. Their impact on our personal finance is indirect.

Therefore, we will focus on the remaining three areas and provide a summary of those measures that have a direct impact on our personal finance in this article. The changes due to those measures are indicated in bold and/or parentheses. The details of the measures can be found on the Ministry of Finance (MOF) budget website (links are given at the end of this article for your reference).

Enhancing Support Measures for Singaporeans

The government is helping Singaporeans cope with the increase in daily expenses due to higher inflation and GST increase by enhancing the permanent GST Voucher (GSTV) and Assurance Package (AP) schemes.

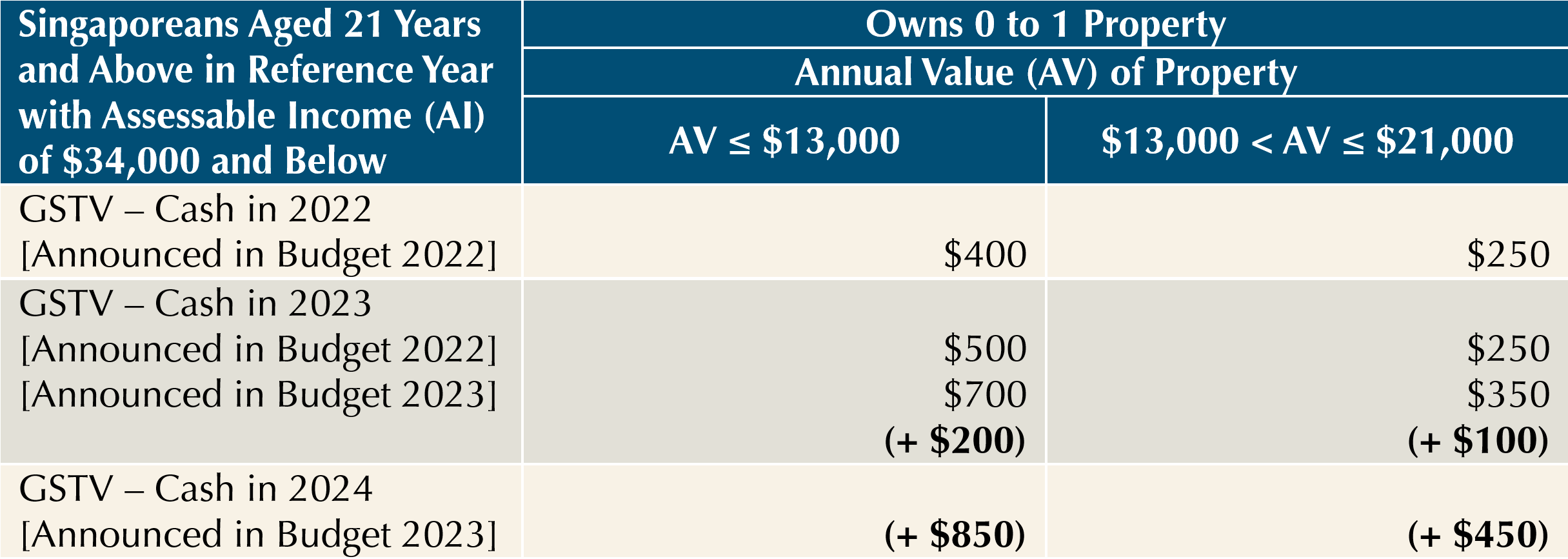

a. Enhancement to GSTV Scheme

The GSTV – Cash quantum will be further increased over 2023 and 2024. The amount of increase is determined by the Annual Value (AV) of the property.

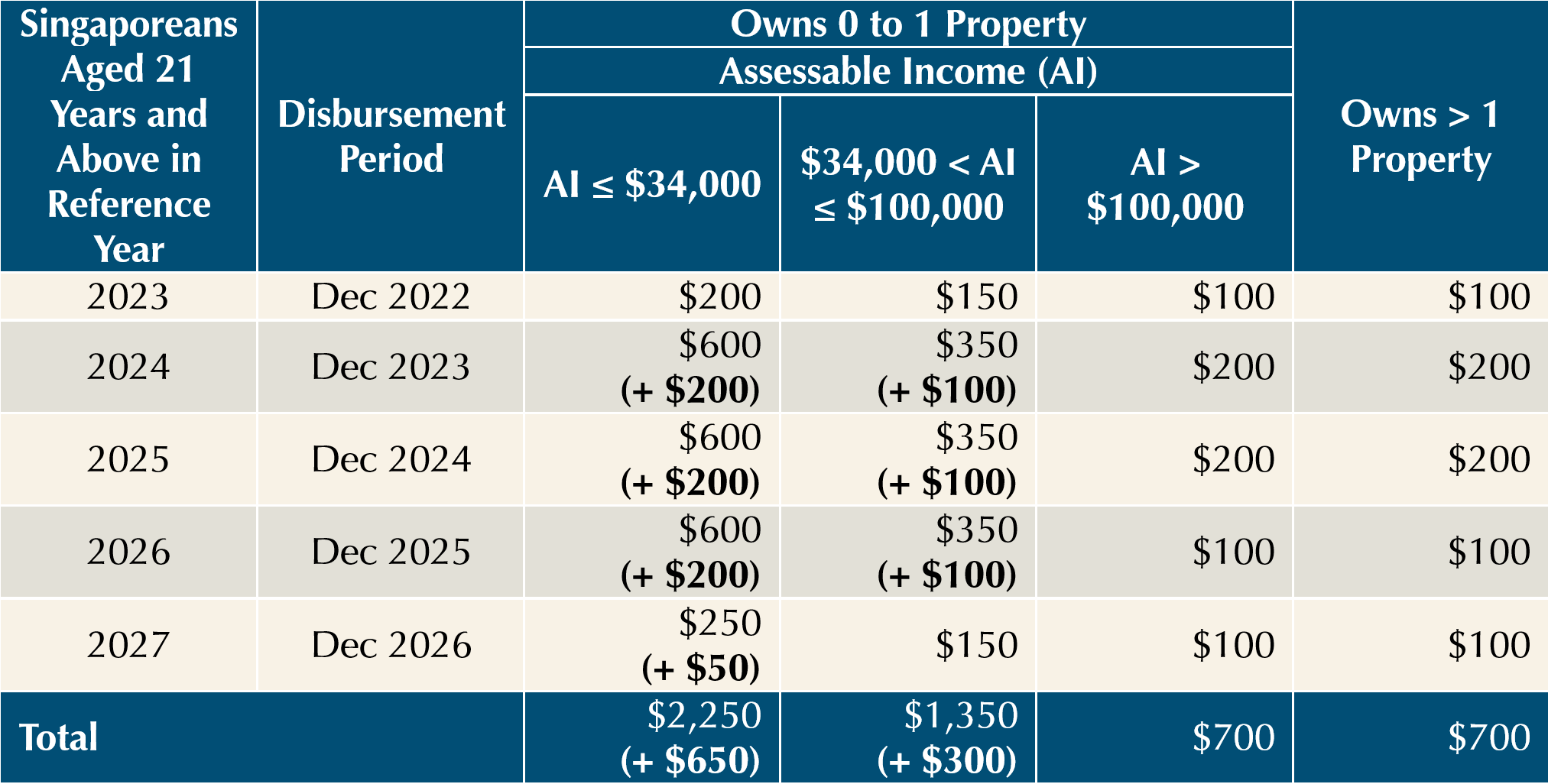

b. Enhancement to AP Scheme

All eligible adult Singaporeans will receive additional AP Cash in December over the remaining years of the AP.

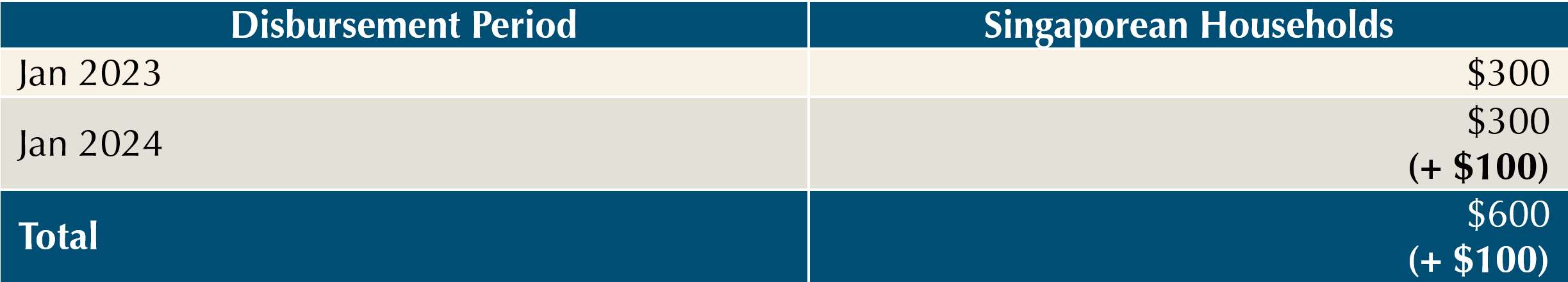

c. Enhancement to Community Development Council (CDC) Voucher Scheme

Every Singaporean household will receive additional $100 CDC Vouchers in January 2024.

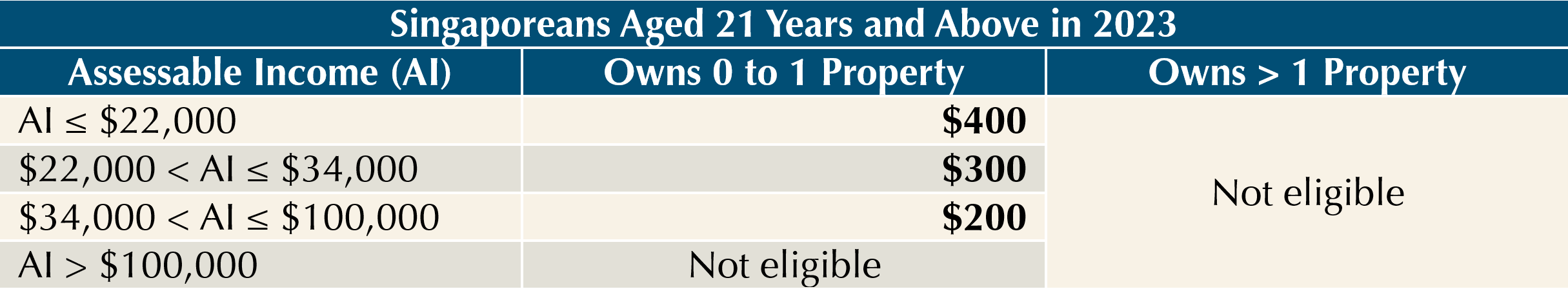

d. 2023 Cost of Living (COL) Special Payment

All eligible adult Singaporeans will receive one-off cash in June 2023.

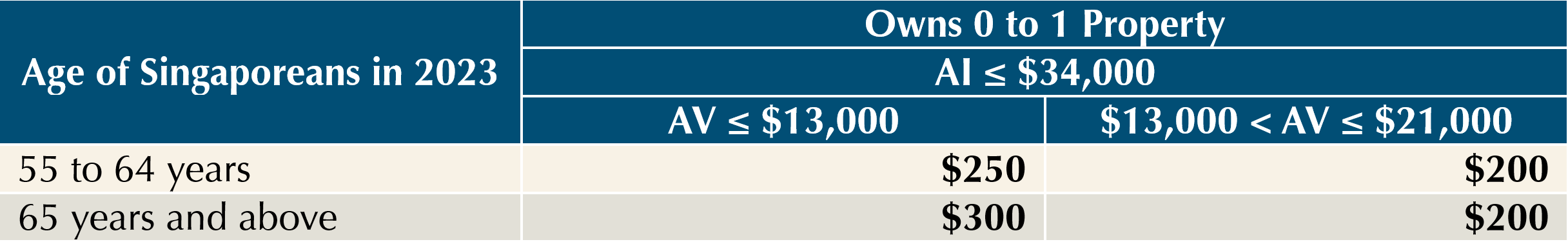

e. 2023 COL Seniors’ Bonus

All eligible senior Singapore citizens will receive one-off cash in June 2023.

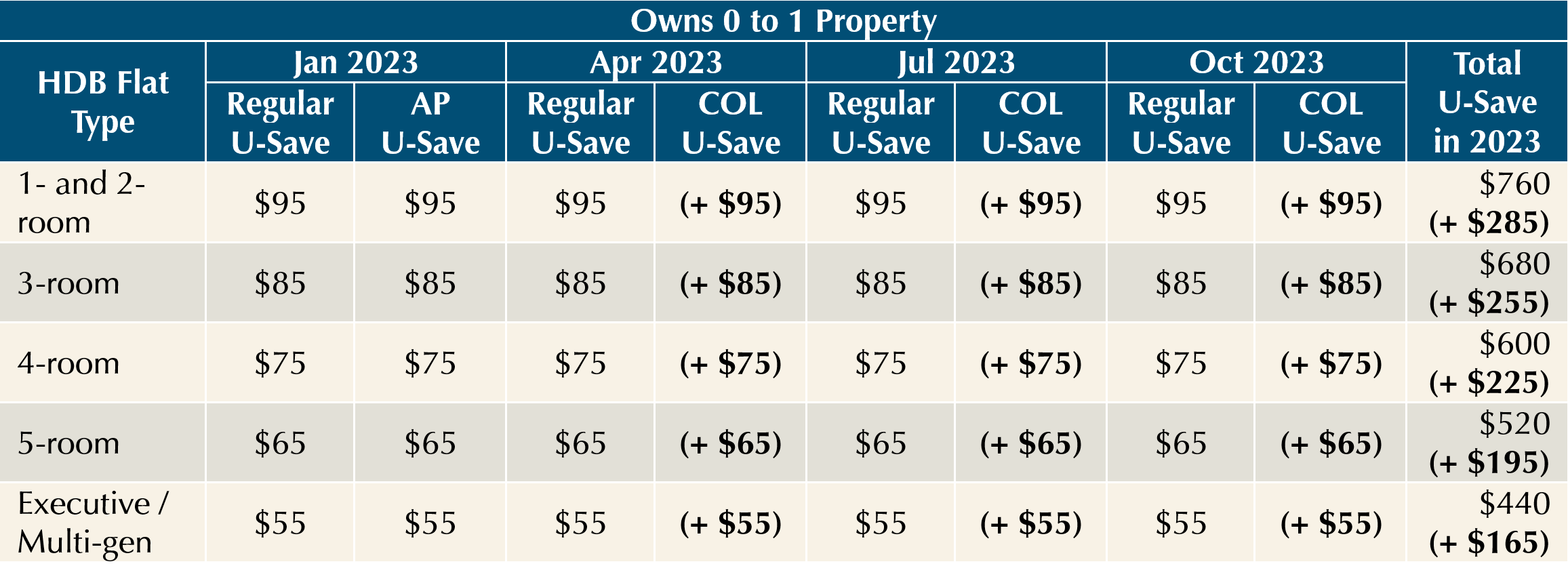

f. 2023 COL U-Save Special Payment

All eligible Singaporean households will receive double the amount of the regular GSTV – U-Save in April 2023, July 2023, and October 2023.

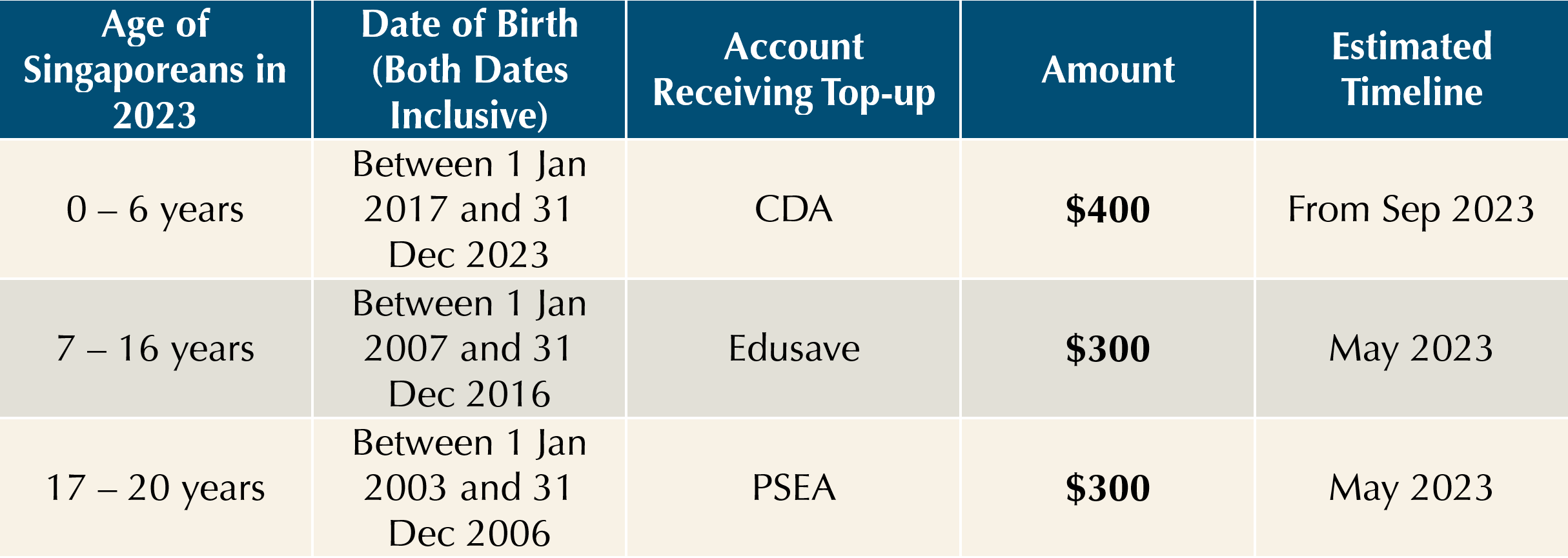

g. 2023 Top-ups to Child Development Account (CDA), Edusave Account, and Post-Secondary Education Account (PSEA)

Families will receive additional one-off support for their children’s expenses in 2023.

Implications of Support Measures

There are altogether 7 measures to defray the increased cost of inflation and GST. The first three measures (a to c) are enhancements to the existing GSTV and AP supports announced in the 2022 budget, and the last four measures (d to g) are new one-off support announced in this year’s budget.

The benefits are given in various forms: cash for general expenses (a, b, d, e), CDC vouchers for spending at participating hawkers, merchants, and supermarkets (c), U-Save Rebates for utility expenses (f), and CDA/Edusave/PSEA top-ups for education expenses (g).

It might be a daunting task trying to estimate the total benefits one can receive from all the measures announced in the past and present budgets. Fortunately, the government has provided a Support Calculator just for this purpose. The link to this calculator is given at the end of this article.

Strengthening Our Social Compact

The government is strengthening our social compact in three key areas: families, income inequality, and ageing population.

a. Building a Singapore Made for Families

i. Increase the CPF Housing Grant by $30,000 for eligible First-Timer Families buying a 2- to 4-room resale flat, and by $10,000 for those buying a 5-room or larger resale flat.

ii. Increase the CPF Housing Grant by $15,000 for eligible First-Timer Singles buying a 2- to 4-room resale flat, and by $5,000 for those buying a 5-room resale flat.

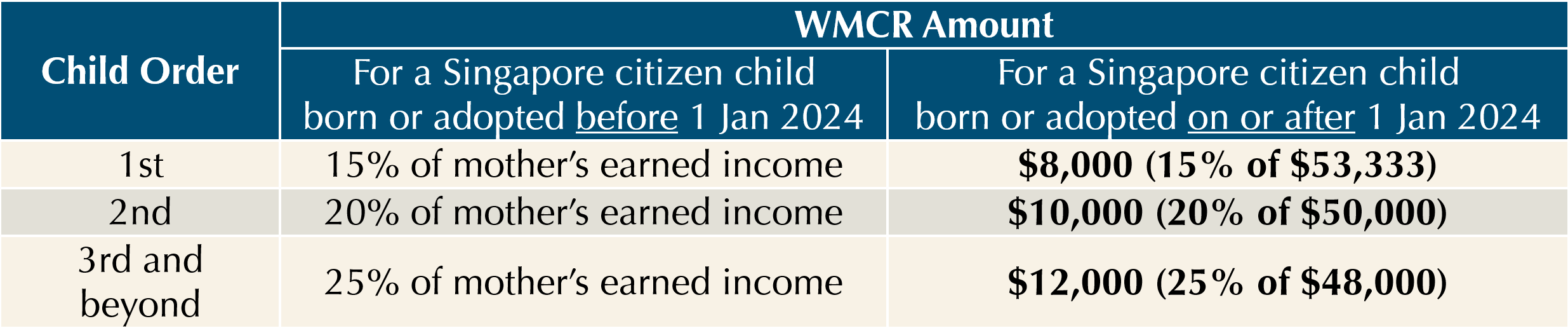

iii. Change in Working Mother’s Child Relief (WMCR) from Percentage of Earned Income to Fixed Dollar Tax Relief with effect from Year of Assessment (YA) 2025.

iv. Lapse the Foreign Domestic Worker Levy Tax Relief (FDWLR) with effect from YA2025, in view of the concessionary migrant domestic worker levy that benefits all families who need help with caring for their dependents.

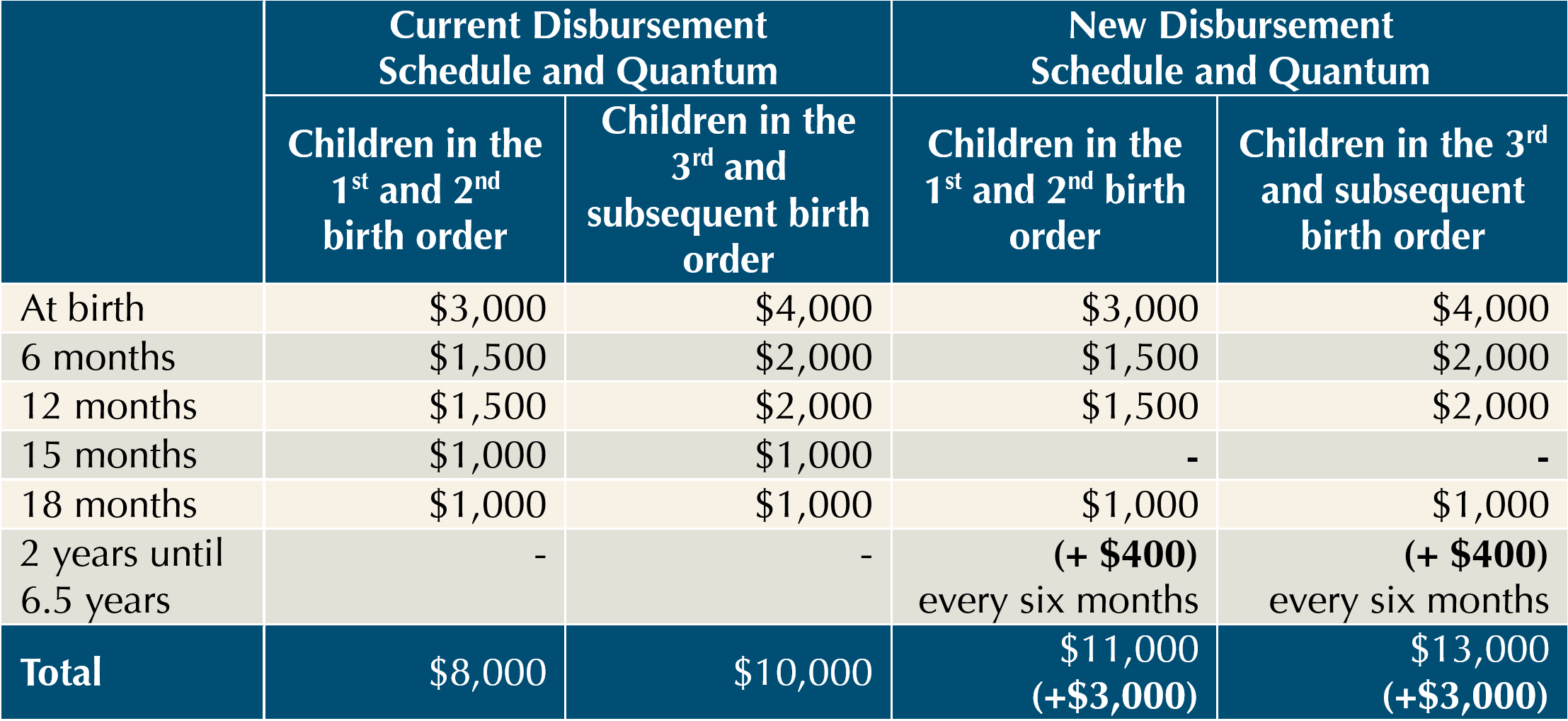

v. Increase the Baby Bonus Cash Gift (BBCG) by $3,000 for eligible Singaporean children.

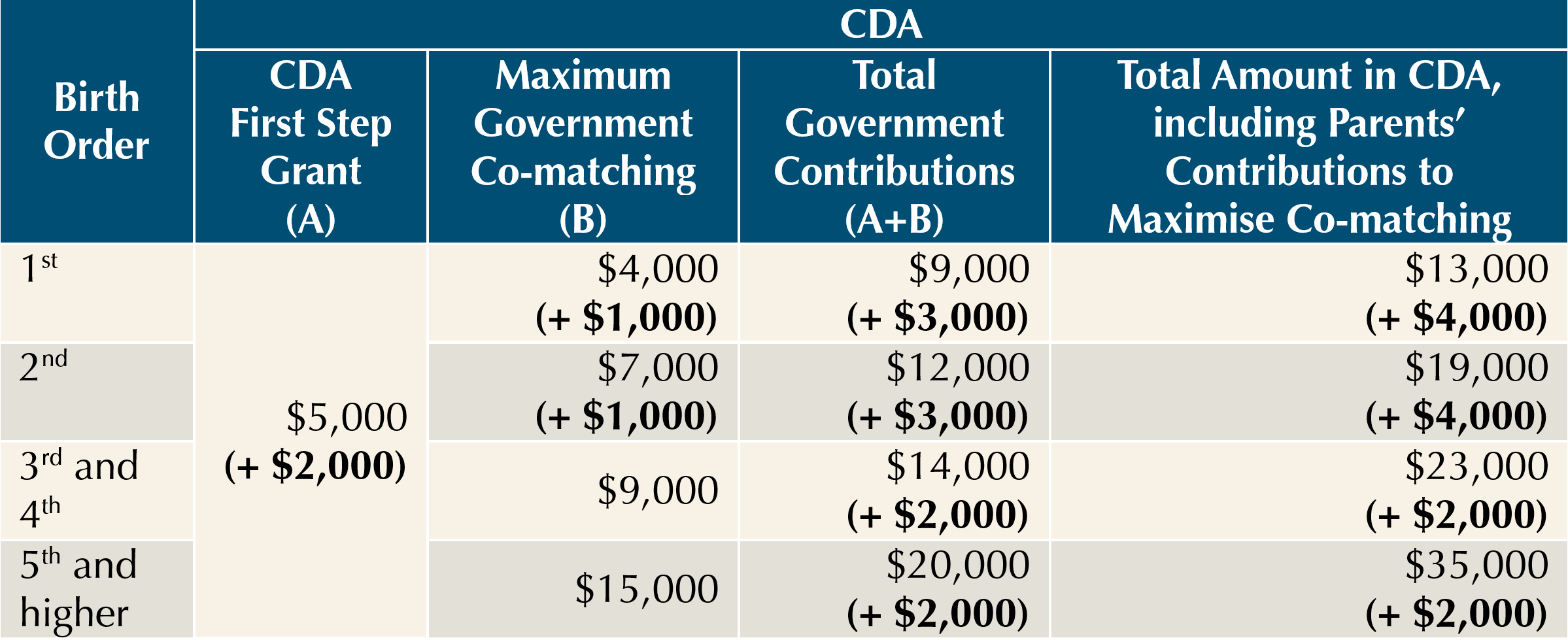

vi. Increase Government Contributions to CDA by Increasing First Step Grant (FSG) and Co-matching Cap.

vii. Extend the Baby Support Grant (BSG) of $3,000 to eligible Singaporean children born from 1 October 2022 to 13 February 2023.

b. Providing Assurance in Our Silver Years

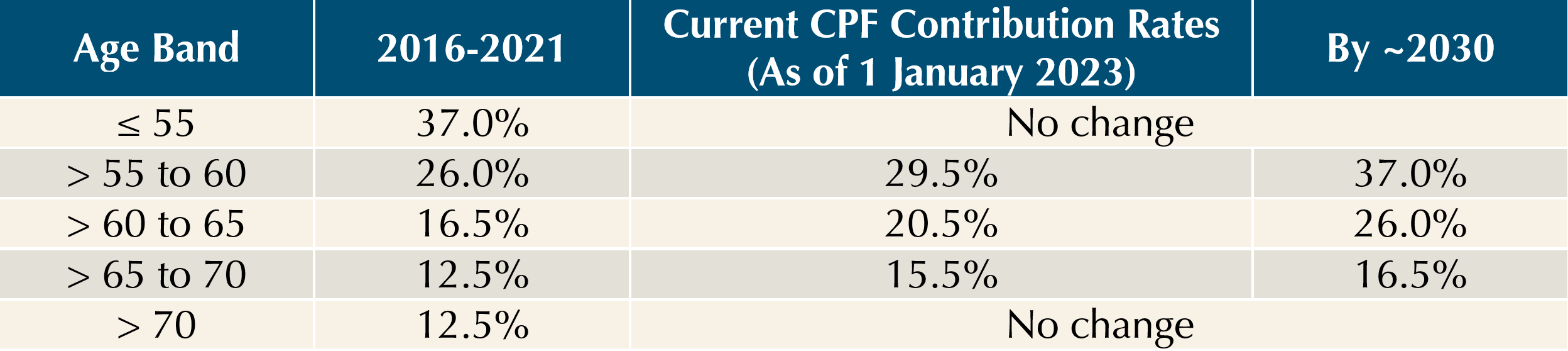

i. Increase in Senior Worker CPF Contribution Rates gradually from 2023 to 2030.

ii. Increase in Minimum CPF Monthly Payouts to $350 for all seniors on the Retirement Sum Scheme (RSS).

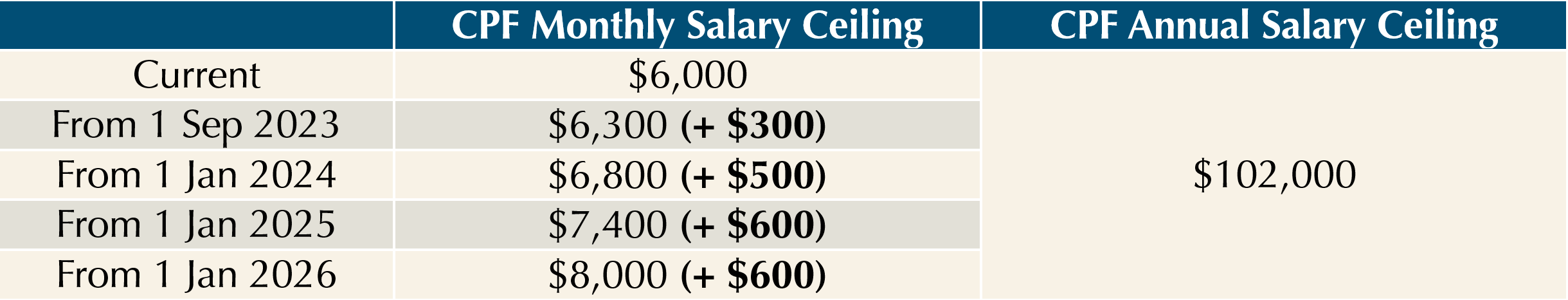

iii. Increase in the CPF Monthly Salary Ceiling from $6,000 to $8,000 by 2026, while maintaining the CPF Annual Salary Ceiling at $102,000.

Implications of Social Compact

1. The CPF Housing Grant will help eligible First-Timer families and singles in purchasing resale HDB flats. They can either opt for taking a smaller loan to reduce their monthly mortgage payments, or casting their net wider for a resale flat with an increased budget.

2. The change in WMCR from percentage to fixed dollar amount will help lower-income working mothers in getting higher tax relief than they could previously. Together with the increase in BBCG, CDA’s FSG and Co-matching cap, and the extension of BSG to include children born before the budget day, they help married couples in their parenthood journey.

However, working mothers with assessable income above $53,333 (1st child), $50,000 (2nd child) or $48,000 (3rd child and beyond) will get lower tax relief and need to budget more for their personal income tax.

3. The increase in senior worker CPF contribution rates was announced in 2019 and the first two steps of increases had already taken place by 1 January 2023. The next increase will happen on 1 January 2024. These gradual increases will allow senior workers in saving more for their retirement.

4. The increase in minimum CPF monthly payout to $350 will help those seniors currently receiving less than $350 on RSS with a higher amount to spend. However, it also means that their RA savings will be depleted sooner. These seniors can opt to join CPF LIFE any time before turning age 80 to receive lifelong payouts.

5. The increase in CPF monthly salary ceiling will help those drawing more than $6,000 salary but less than $30,000 bonus with higher CPF contributions, which will help them achieve a higher retirement nest egg, but reduce their disposable income from lower take-home pay.

Maintaining a Competitive, Resilient, and Fair Tax System

The government is making further adjustments to our tax structure.

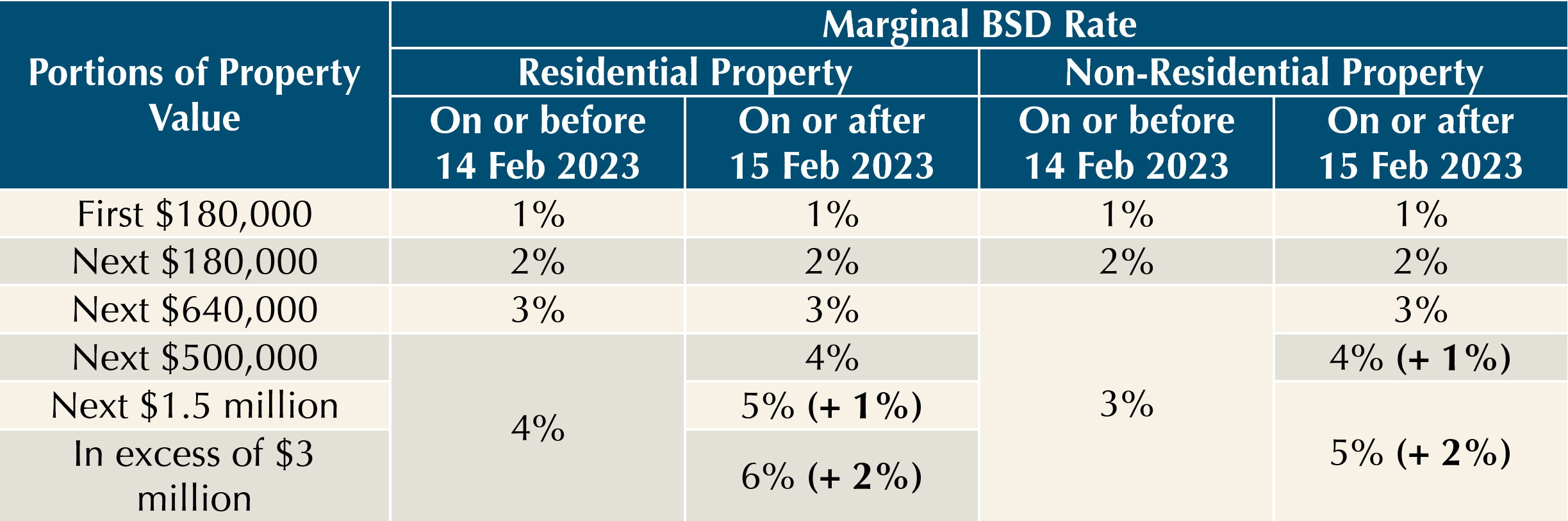

a. Increase Buyer’s Stamp Duty (BSD) rates for higher-value properties

BSD is increased for residential property in excess of $1.5 million and non-residential property in excess of $1 million.

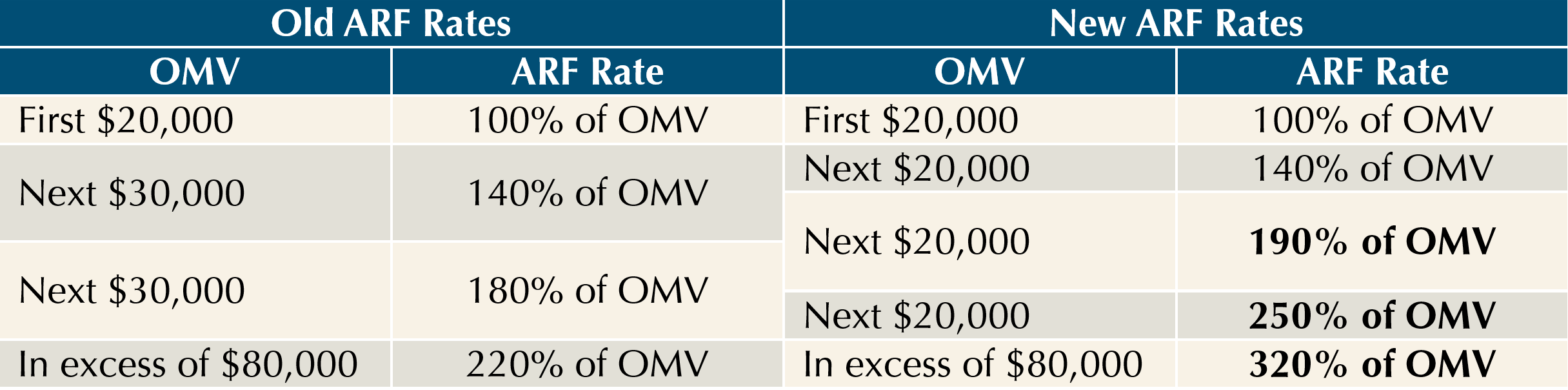

b. Increase Additional Registration Fee (ARF) rates for higher-end and luxury cars

ARF is increased for cars with Open Market Value (OMV) of more than $40,000.

c. Cap Preferential ARF (PARF) rebates at $60,000 to avoid excessive rebates to more expensive cars upon deregistration

d. Increase excise duty on tobacco products by 15% to discourage their consumption

Implications of Tax Changes

Obviously, the tax changes will impact more on the buyers of higher-value properties and vehicles through BSD and ARF respectively. In addition, PARF rebates are also capped when more expensive cars are deregistered. Last but not least, the consumption of tobacco products is discouraged by the increase of excise duties.

Warmest regards,

Solutions Team

Reference Links

MOF Singapore Budget Website:

https://www.mof.gov.sg/singaporebudget

FY2023 Singapore Budget Statement:

https://www.mof.gov.sg/singaporebudget/budget-2023/budget-statement

FY2023 Singapore Budget Speech Video:

https://www.mof.gov.sg/singaporebudget/resources/videos

FY2023 Singapore Budget Booklet:

https://www.mof.gov.sg/singaporebudget/resources/budget-booklet

FY2023 Singapore Budget Infographics:

https://www.mof.gov.sg/singaporebudget/resources/budget-infographics

FY2023 Singapore Budget Navigator:

https://www.mof.gov.sg/singaporebudget/resources/budget-navigator

FY2023 Singapore Budget Support for Households:

https://www.mof.gov.sg/singaporebudget/resources/support-for-households

FY2023 Singapore Budget Support Calculator:

https://supportgowhere.life.gov.sg/budget/support-calculator

GST Voucher (GSTV) Scheme:

https://www.gstvoucher.gov.sg/

Assurance Package (AP) Scheme:

https://govbenefits.gov.sg/

Community Development Council (CDC) Voucher Scheme:

https://vouchers.cdc.gov.sg/