This is part 2 of my second article written in the capacity of Solutions Specialist at Providend looking at wealth planning for children tertiary education. The article was first published on Providend website here:

https://providend.com/wealth-planning-for-your-childs-tertiary-education-part-2-achieving-the-financial-goal/

In Part 1 of this article, we established a baseline financial goal for your children’s tertiary education. We now turn our attention to wealth planning for achieving this goal.

Inflation of Financial Goal

Based on the country selection (Singapore, Australia, United Kingdom, or United States) and academic field (medicine vs non-medicine), we have determined a baseline lump sum goal to set aside for tertiary education from our research data in Part 1.

By considering the inflation rates for tuition fees and living expenses, we projected the inflation-adjusted lump sum goal that you should aim for when it is time to send your children for tertiary education. The following graph shows the cost inflation for non-medicine courses in the 4 countries we cover:

We can see from the graph that the total education cost will inflate over time, approximately doubling in 20 years. Therefore, you would want to start planning for your children’s education fund early.

For overseas universities, there is an added uncertainty in the currency exchange rate. We won’t be able to predict the foreign currency movement in the future with certainty. So what you can do is to add a buffer amount to the goal for any possible SGD depreciation against the targeted foreign currency.

With so many moving parts, we know the targeted education fund amount is based on best estimates. You would need to review and revise the amount regularly to cater for changes in education needs, university landscape, inflation rates, and currency movement.

Creating a Financial Plan

After setting a goal to achieve in a suitable time horizon, you can create a financial plan using the following steps:

- Assess your current financial situation

Take stock of your current assets, liabilities, income, and expenses. Determine how much you can commit to your children’s education goals. - Calculate the required savings/investment amount in your children’s education fund

Consider expected investment returns to determine how much you need to save and invest to reach your goal. Open a separate account to deposit the initial lump sum and set up a regular saving mechanism if necessary. - Select an appropriate investment vehicle

Consider various investment options based on your risk tolerance, time horizon, and expected returns. Diversify your investments to manage risk and returns. - Monitor and adjust your plan

Regularly review your financial goal amount and track your investment returns against your goal. If necessary, adjust your plan to cater for changing circumstances. - Consider professional advice

If you are not comfortable about financial planning and investing on your own, consider engaging a trusted financial advisor to guide you in creating a plan based on your specific situation.

Risk Tolerance

An important factor that determines the appropriate investment vehicle is your risk tolerance, which is how much volatility you can tolerate in the investment. At Providend, we use a process of risk profiling to determine your willingness, ability and need to bear risk:

- Willingness to bear risk

This refers to your emotional comfort level with uncertainty and the potential for loss. Your willingness to bear risk can vary depending on factors such as personal temperament, past experiences, and risk preferences. - Ability to bear risk

This refers to your financial capacity to absorb and recover from potential losses, and the ability to hold through the time horizon without having the need to liquidate your investment prematurely. Your ability to bear risk is determined by your personal financial health, such as having adequate emergency funds, sufficient insurance coverage and job stability. - Need to bear risk

This refers to the amount of risk you need to take to achieve your financial goal. Your need to bear risk is influenced by factors such as growth target, time horizon and desired level of return on investment. The higher the investment return you seek, the higher is your need to bear risk.

It is important to consider these 3 factors when assessing your risk tolerance and making decisions related to your financial plan and investment instruments. This will allow you to make more informed investment and cash flow decisions that are more likely to help you achieve your financial goals.

Case Study

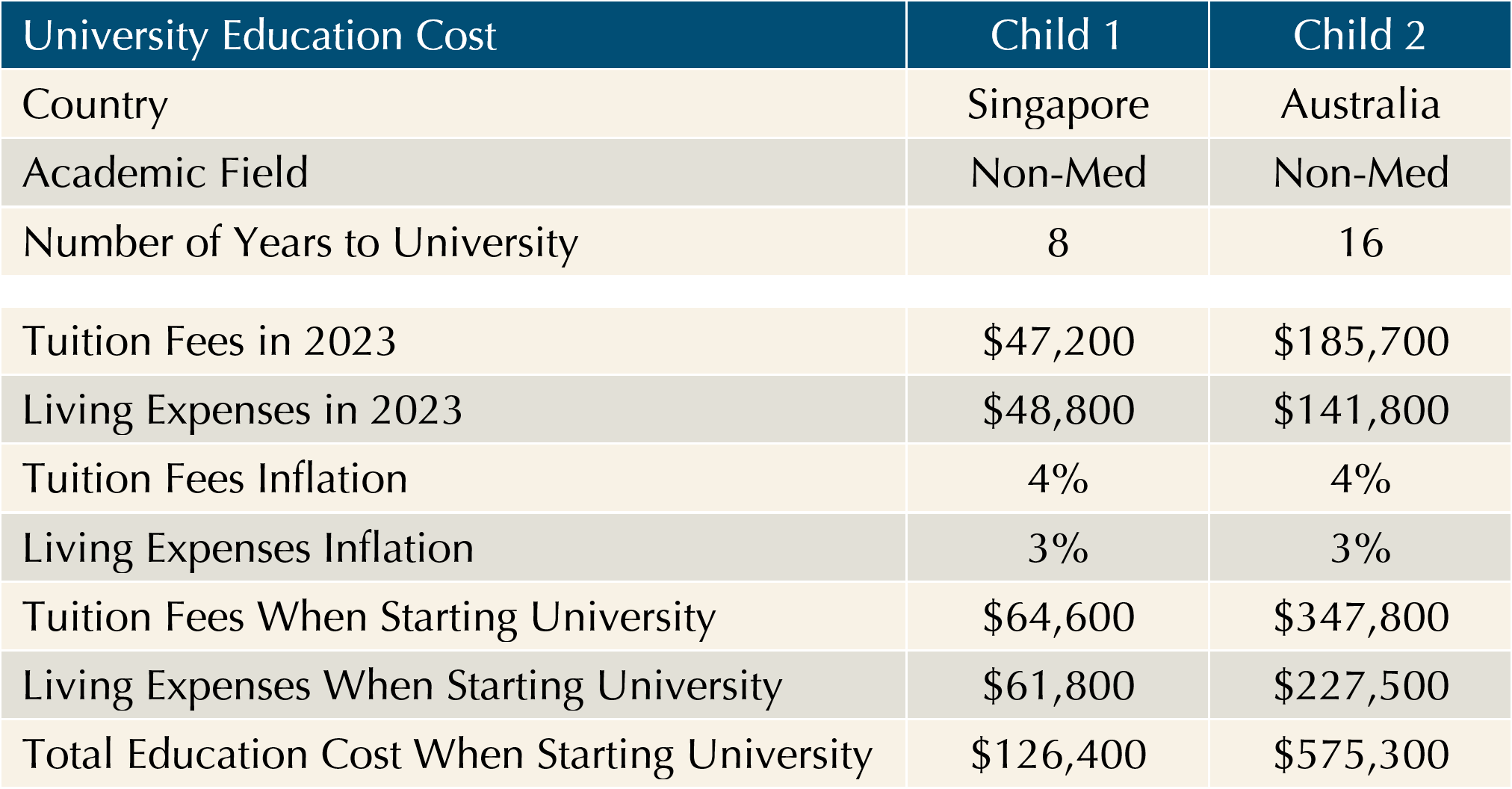

Let us look at an example. Suppose you have 2 kids, who will be entering university 8 and 16 years later respectively. You plan to send them to non-medicine courses, one to a local university and the other to Australia. The following table shows the projected education costs based on our research data in Part 1:

The inflation-adjusted education cost is projected to be $126,400 and $575,300 when your 2 kids are starting their respective university courses. Let us assume that you can set aside $300,000 for their university education, and that your risk profile is assessed to be high risk.

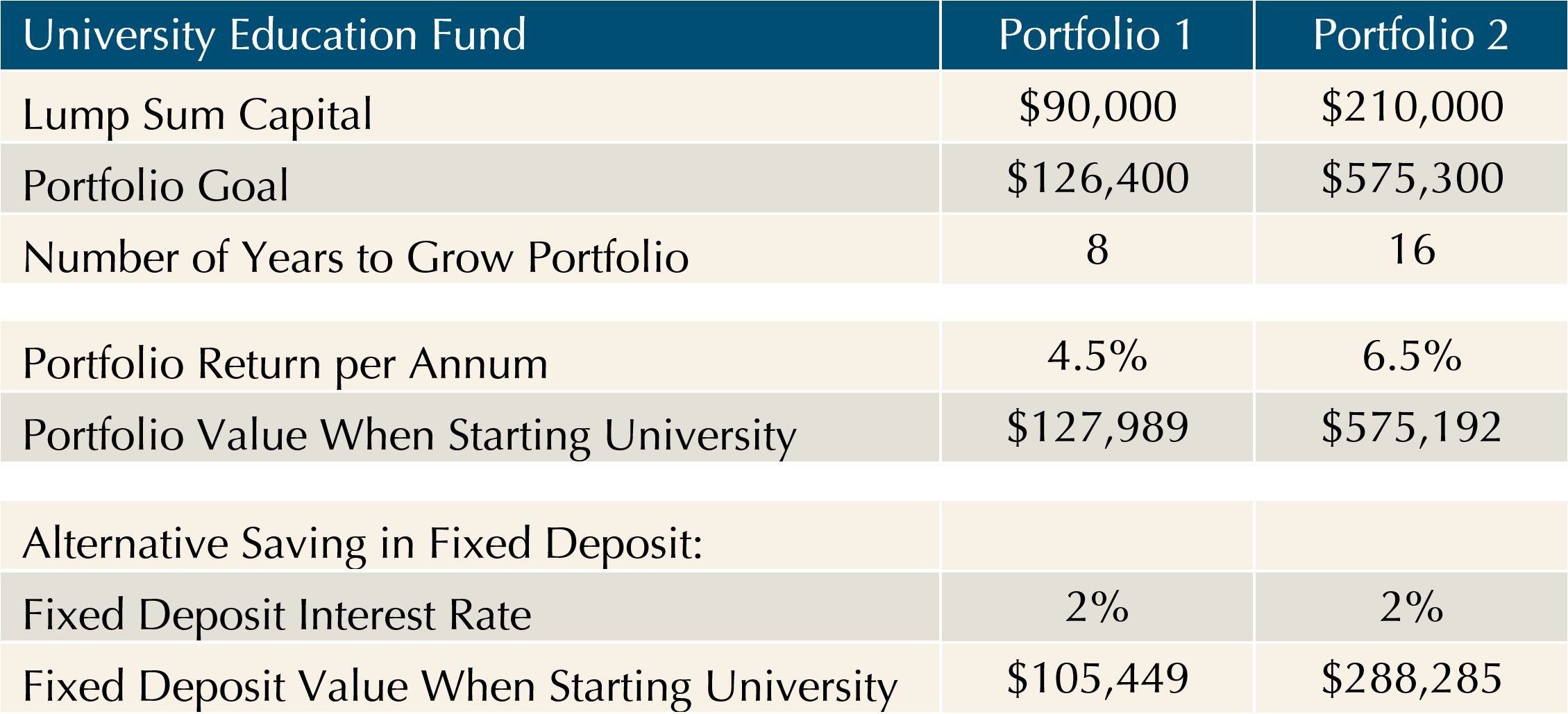

We can consider 2 portfolios[1], one for each child’s education fund. Portfolio 1 for child 1 is a balanced portfolio of 60% equity and 40% bond delivering 4.5% p.a. return. Portfolio 2 for child 2 is a 100% equity portfolio delivering 6.5% p.a. return.

The table below presents two portfolios in which the $300,000 is divided, along with a comparison to the portfolio values if the same capital is invested in a fixed deposit with a 2% p.a. interest rate:

We can see that the 2 portfolios proposed would be able to meet the financial goals you set for the 2 kids if your capital is invested in equities and bonds. If you choose to place your capital in fixed deposits, you will need larger capital, almost double the capital for portfolio 2 to meet its goal.

Conclusion

With the anticipated rise in education costs due to inflation, it is vital to include a children’s education fund in your wealth planning for the family.

The total cost of university education can range from $100,000 to $1 million in SGD today, depending on many factors such as country, university, academic field, degree level, inflation, and foreign currency exposure. It is not a small amount to set aside and requires a well-considered financial plan to achieve successfully.

Effective education planning entails careful consideration of your children’s education needs and thus the financial goal, which we examined in the first part of this article; and proactively formulating and managing a financial plan to achieve this goal, which we explored in the second part.

Neither the goal nor the plan are cast in stone. You need to regularly review the financial goal, to see if it needs to be adjusted to meet your children’s education needs during their formative years. You also need to regularly review the financial plan, to ensure the investment performance is on track to meet our goal. Should there be deviations in the goal and performance, you will need to adjust your plan accordingly.

In conclusion, planning for your children’s education is a proactive and thoughtful approach to securing a bright future for them. By understanding their unique needs, setting clear goals, making financial plans, and adapting the plans over time, you can be in a much better position to provide your children with the necessary foundation and opportunities to thrive academically, personally, and professionally.

– Footnotes –

[1] The returns of the 2 portfolios are stated for illustration purposes and would depend on the actual performance of the underlying assets.