An article written by the Solutions Team and first published on Providend website here:

https://providend.com/singapore-budget-2024-highlights-on-personal-finance/

On 16 February 2024, Deputy Prime Minister and Finance Minister Lawrence Wong gave his Budget Speech “Building Our Shared Future Together”. The Singapore Budget 2024 has come after a year filled with geopolitical tensions, and a subdued global economy, resulting in rising costs for individuals, families, and businesses.

Recognising the inflationary pressures faced by our families and businesses, the government has set out this year’s budget to address these concerns and take steps to realise our vision for a better Singapore under Forward Singapore.

Key focus of Singapore Budget 2024:

- Tackling immediate challenges

- Pursuing better growth and jobs, and equipping our workers for life

- Creating more paths towards equality and mobility

- Providing more assurance for families and seniors

- Forging a stronger and more united nation

In this article, we will focus on those measures in the budget that have a direct impact on our personal finance. The changes due to those measures are indicated in bold and/or parentheses.

Enhancing Support Measures for Singaporeans

The government is meting out enhancements to various support measures to help Singaporeans tackle the immediate challenges of the rising cost of living.

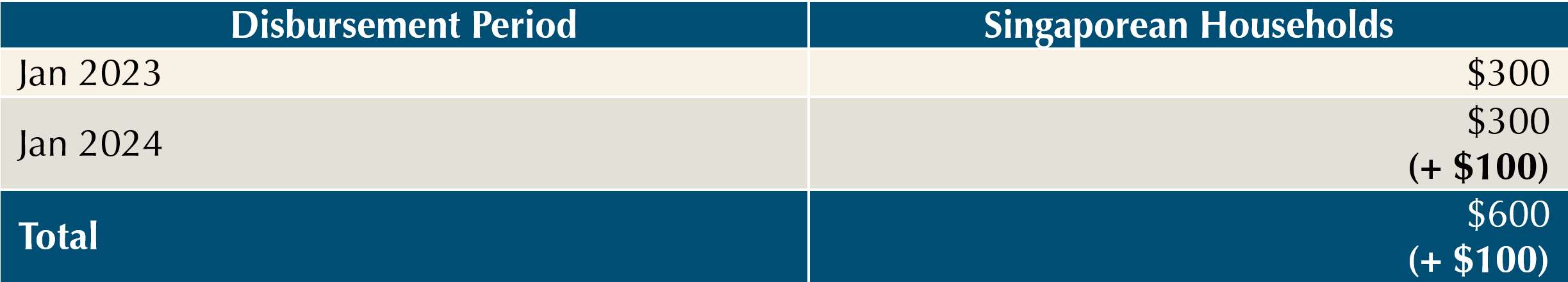

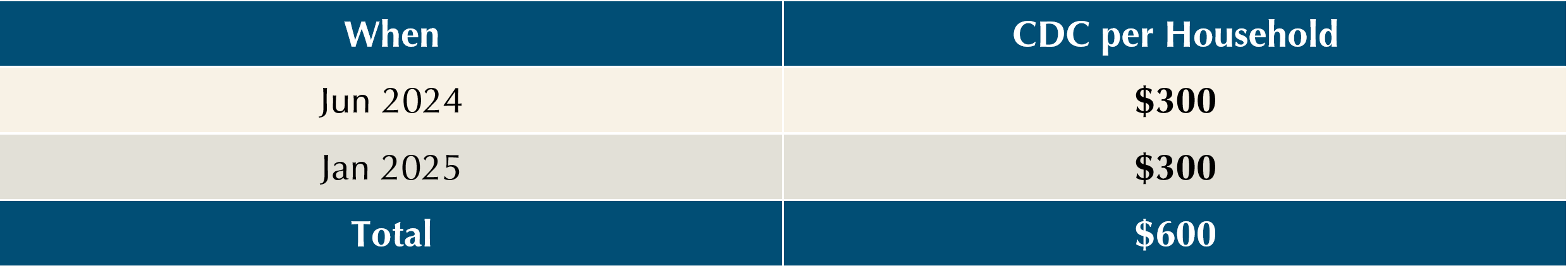

a. Enhancement to Community Development Council (CDC) Voucher Scheme [One-Time]

Every Singaporean household will receive an additional $600 CDC Vouchers on top of the existing vouchers they had received earlier. They will receive the $600 vouchers in 2 tranches, $300 in June 2024 and $300 in January 2025.

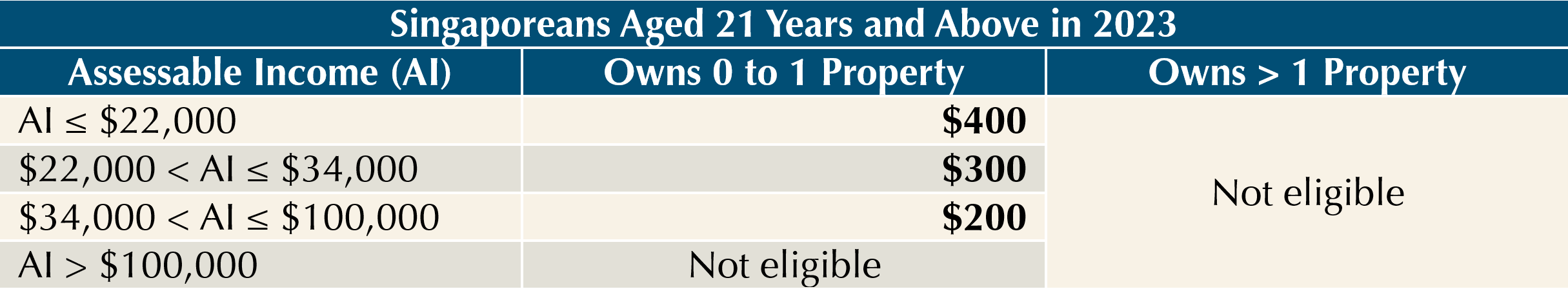

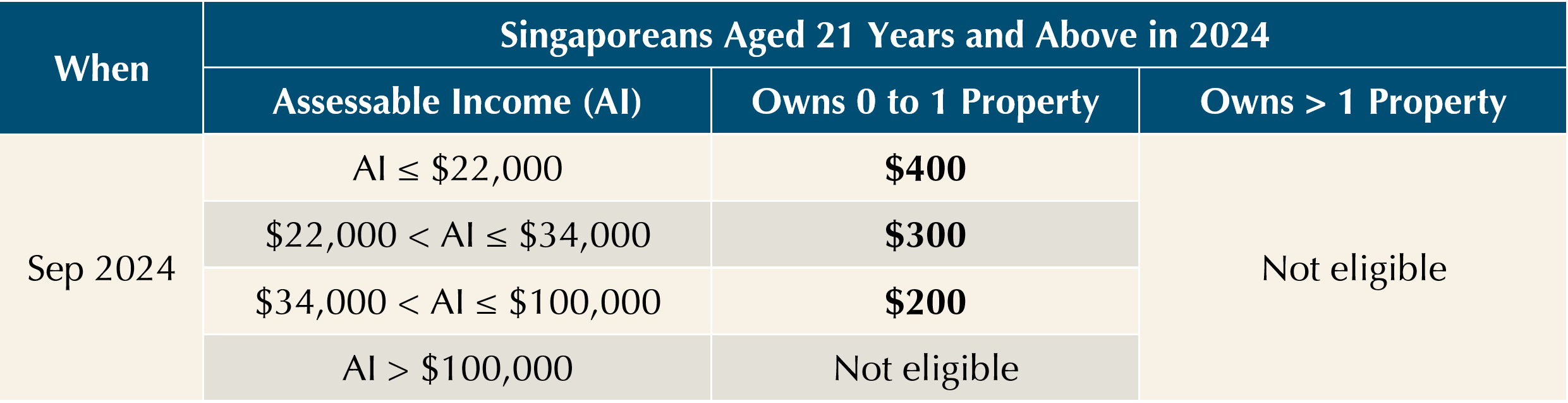

b. 2024 Cost of Living (COL) Special Payment [One-Time]

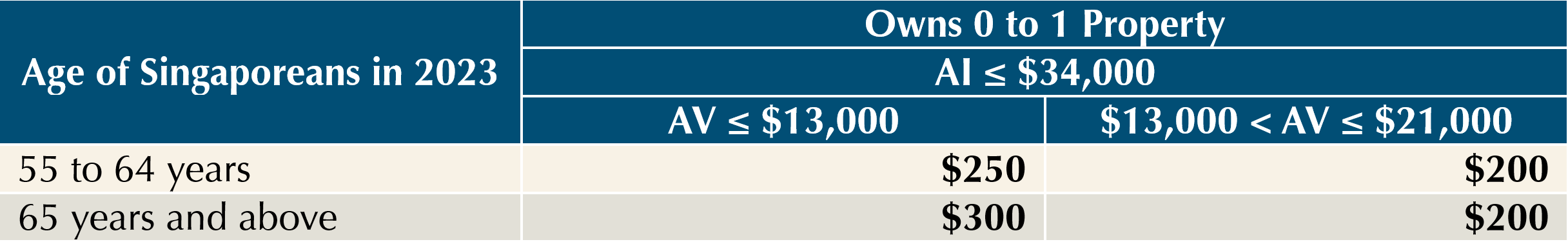

All eligible adult Singaporeans will receive one-off cash payment of between $200 and $400 in September 2024, depending on their assessable income and property ownership.

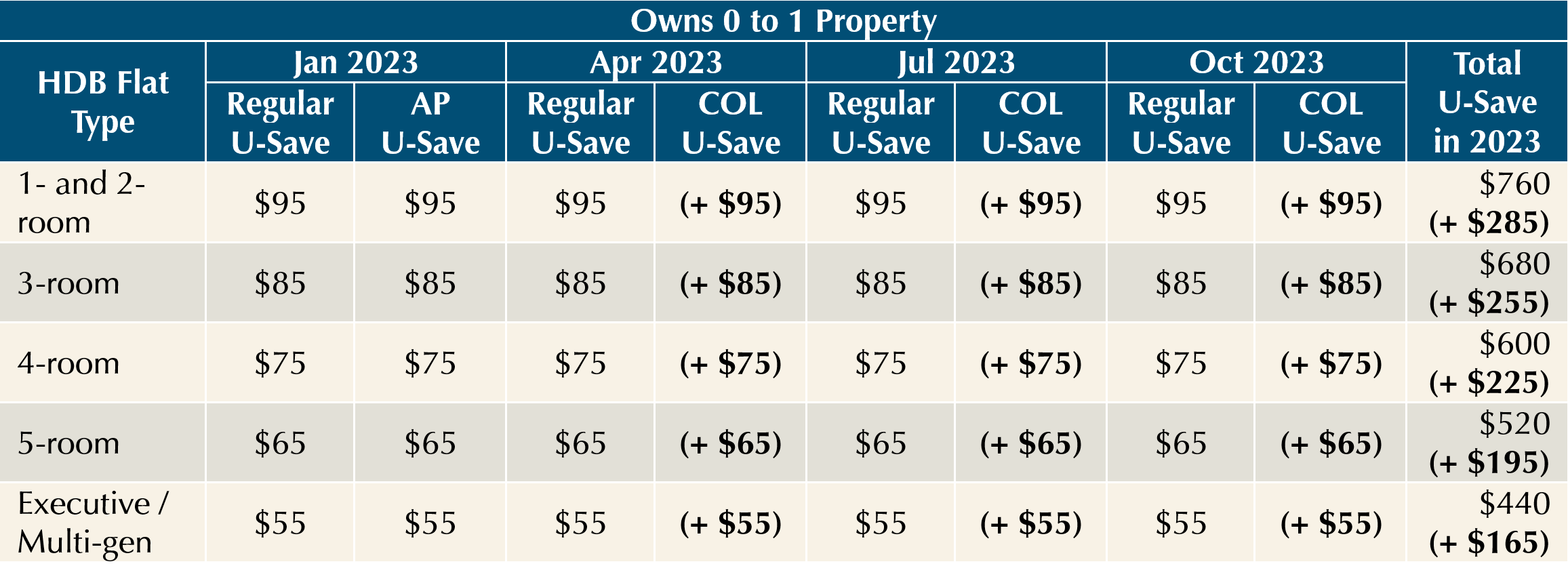

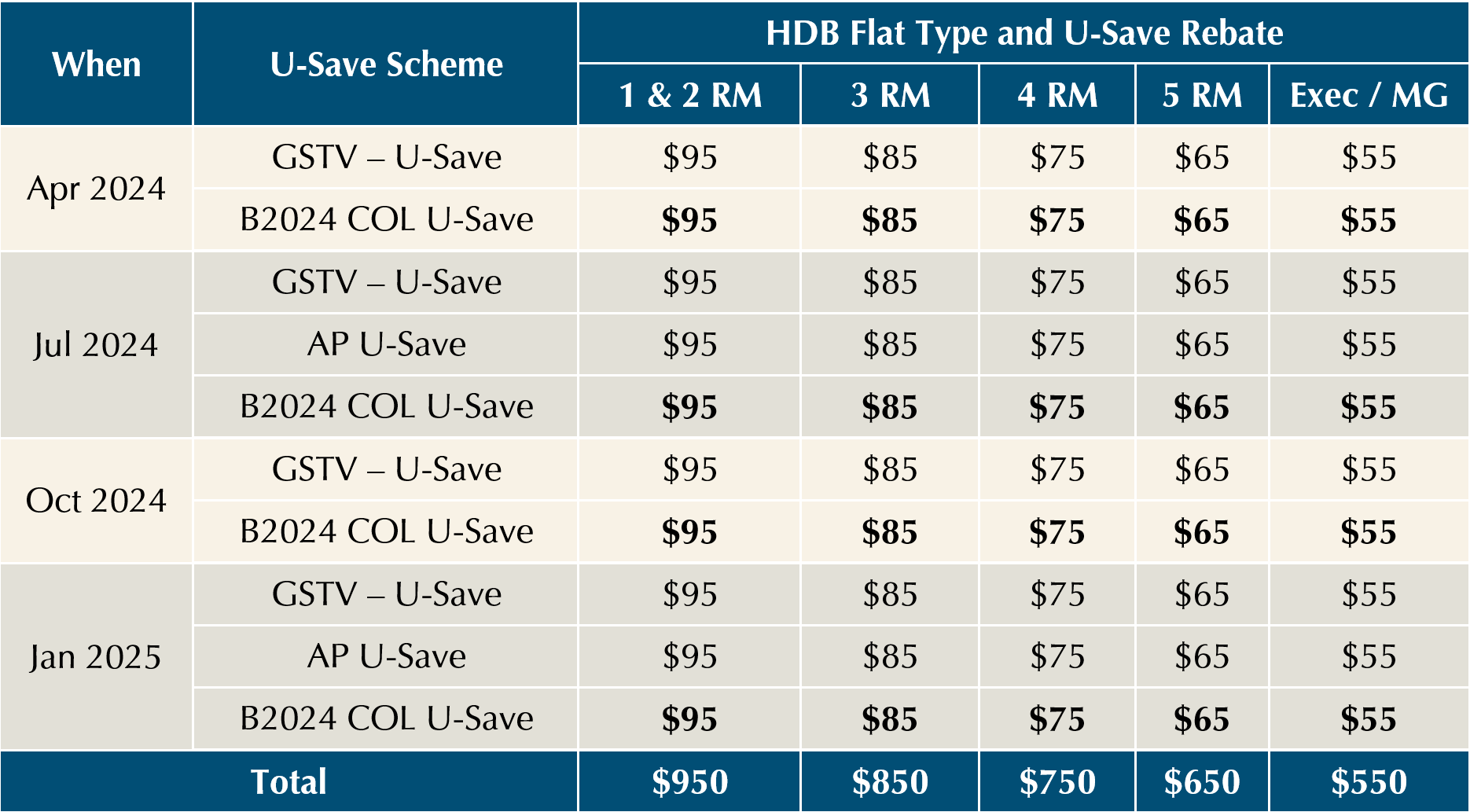

c. 2024 COL U-Save Rebate [One-Time]

All eligible Singaporean households living in HDB flats and whose household members do not own more than one property will receive one-off 2024 COL U-Save Rebate to help offset their regular utilities expenses. This rebate will be disbursed in April 2024, July 2024, October 2024, and January 2025.

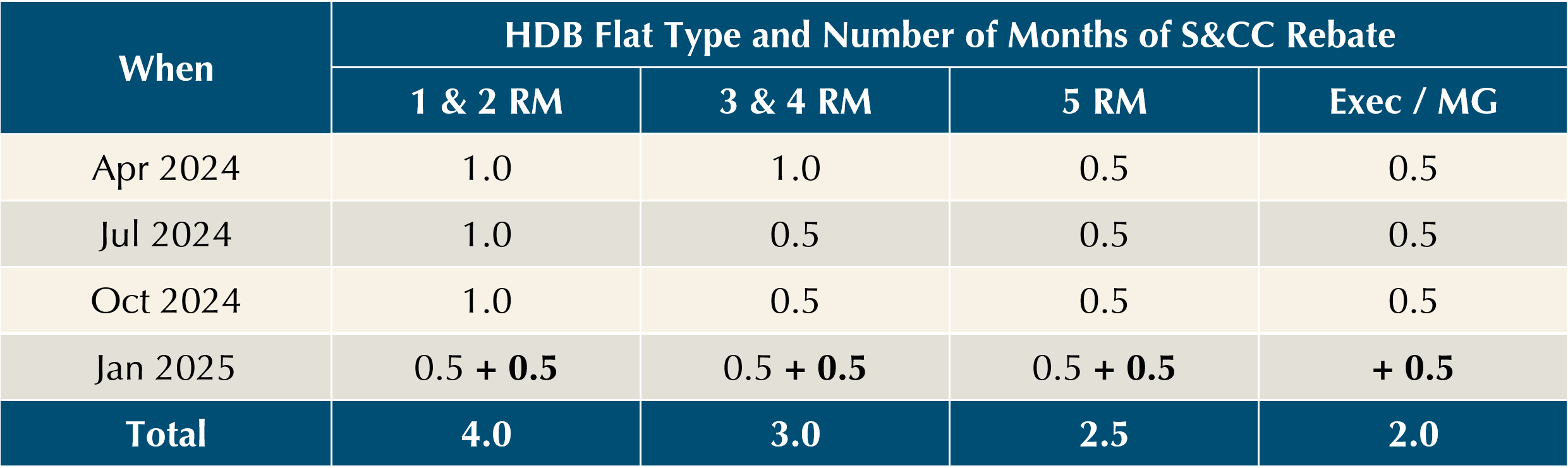

d. 2024 Service and Conservancy Charges (S&CC) Rebate [One-Time]

All eligible Singaporean households living in HDB flats will receive one-off 2024 COL S&CC Rebate to offset 0.5 months of S&CC in January 2025. In total, eligible HDB households will receive up to 4 months of S&CC rebates in FY2024.

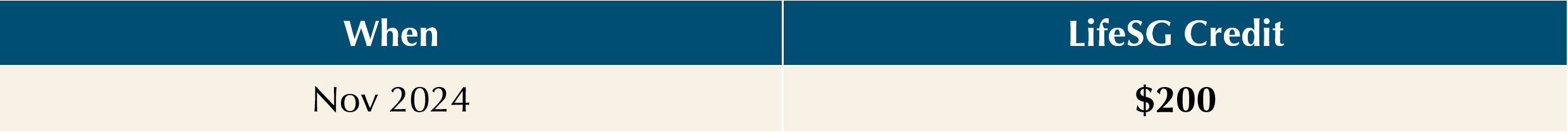

e. 2024 National Service (NS) LifeSG Credit [One-Time]

All eligible national servicemen enlisted by 31 December 2024 will receive $200 in LifeSG credits in November 2024.

Equipping Our Workers for Life

The government is investing heavily in our human capital through education. We need to systematically support our workers in reskilling and upskilling, equipping them with the necessary skills to harness new technologies more effectively and remaining high in the value chain.

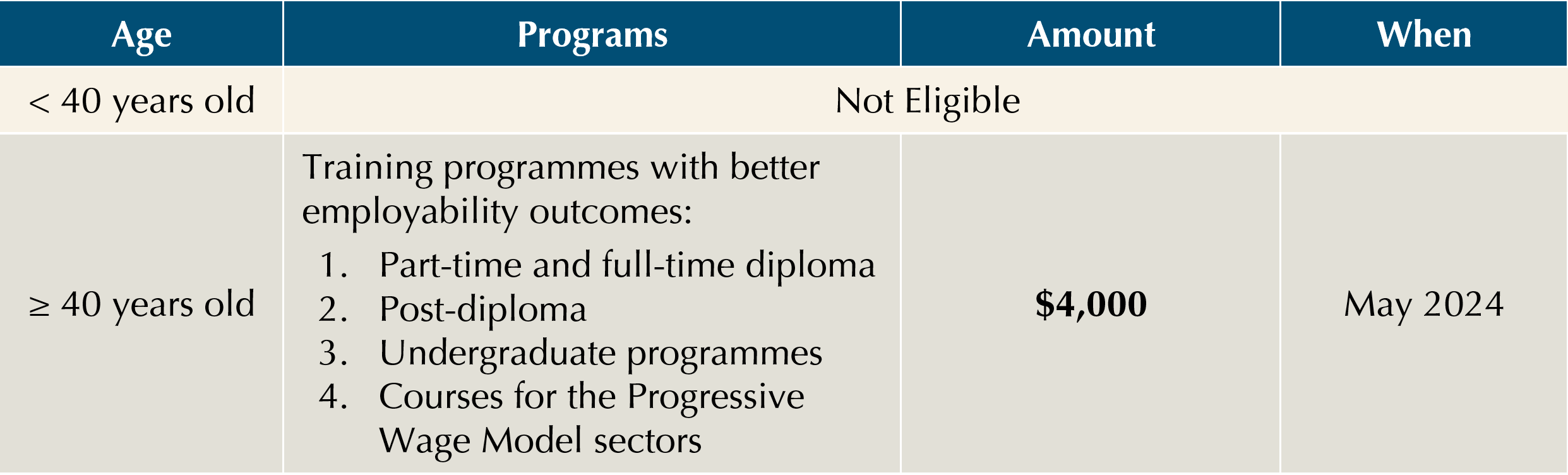

a. SkillsFuture Level-Up Programme

i. $4,000 SkillsFuture Credit (SFC) Mid-Career Top-Up [One-Time]

Every Singaporeans aged 40 and above will receive the $4,000 SFC top-up in May 2024. The new SFC will be more targeted at selected courses that are industry-oriented and have better employability outcomes.

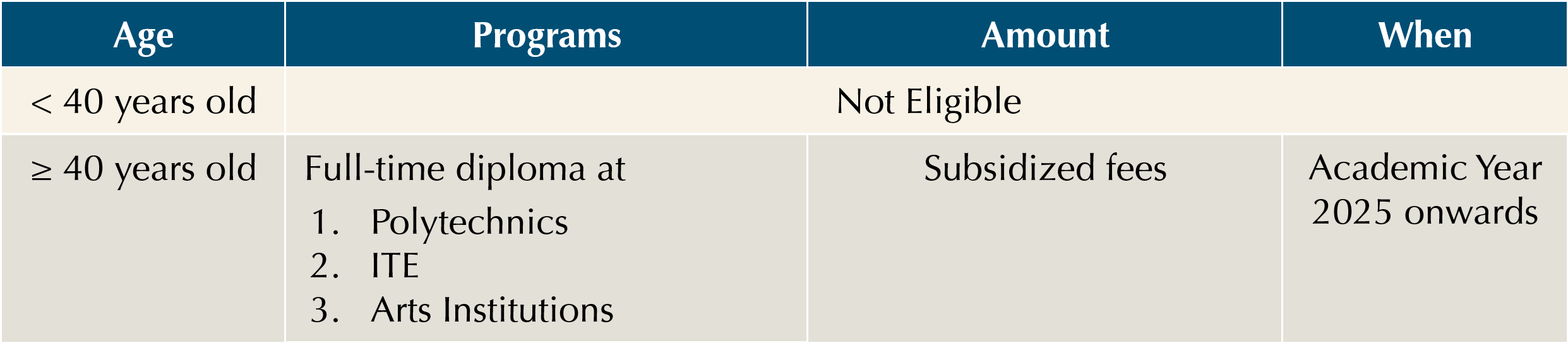

ii. Mid-Career Enhanced Subsidy for Full-Time Diploma [One-Time]

Every Singaporean aged 40 and above will have another bite of the education subsidy to pursue a full-time diploma at a subsidised rate from Academic Year 2025 onwards, even after they have graduated from an Institution of Higher Learning.

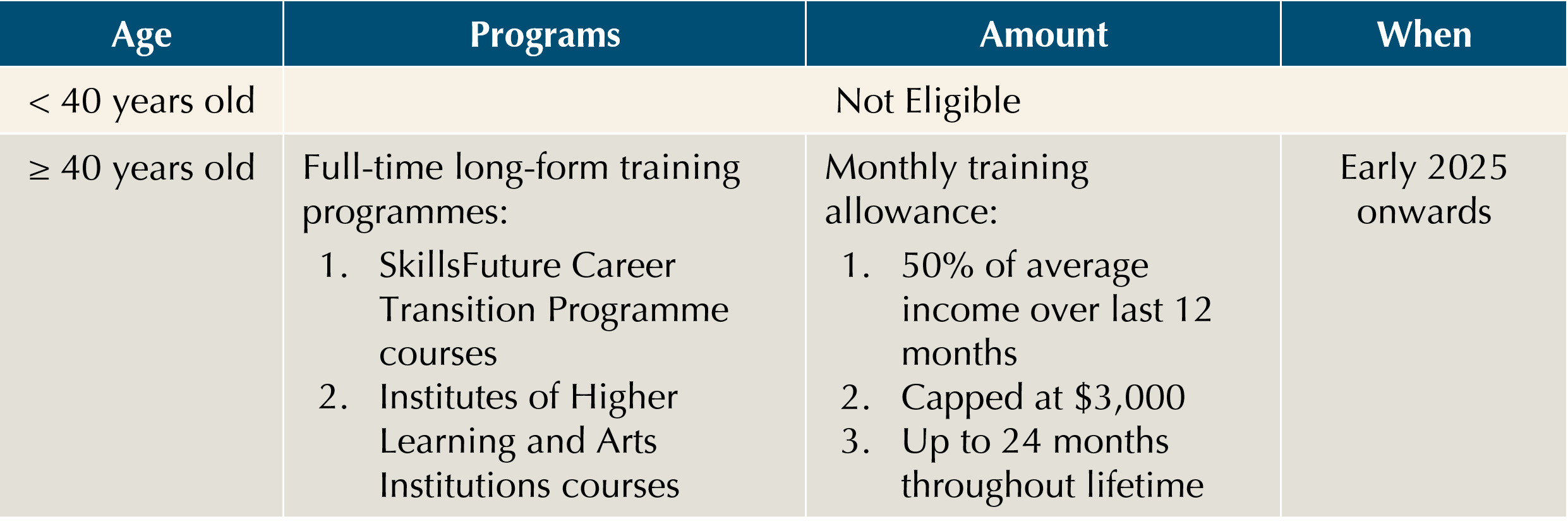

iii. SkillsFuture Mid-Career Training Allowance [Monthly up to 24 Months]

Every Singaporean aged 40 and above will receive a training allowance for undertaking full-time long-form training from early 2025 onwards.

b. Temporary Financial Support Scheme for the Involuntarily Unemployed [TBD]

The government will introduce a temporary financial support scheme for the involuntarily unemployed while they undergo training or look for better-fitting jobs. More details to be provided later this year.

Strengthening Retirement Adequacy

The government is strengthening and rationalising the retirement system.

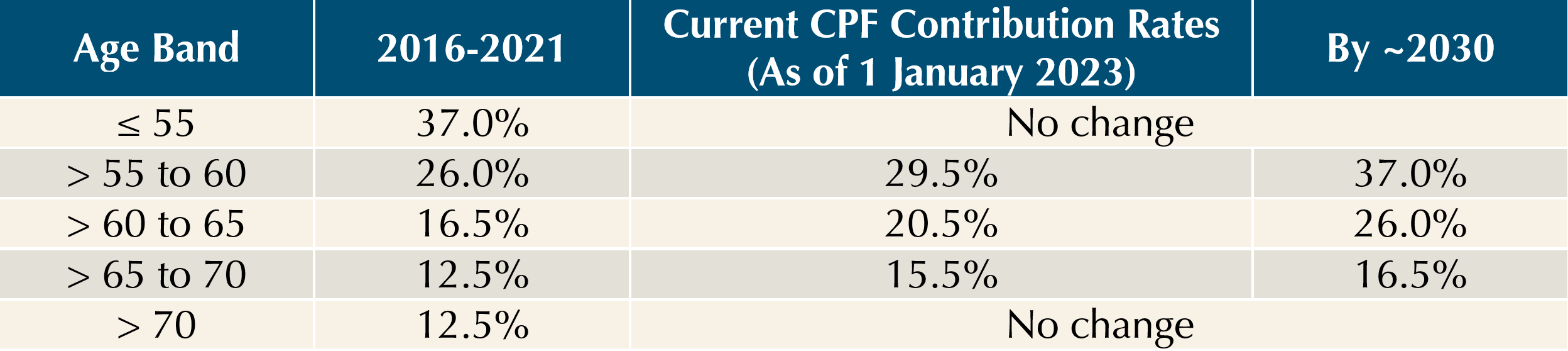

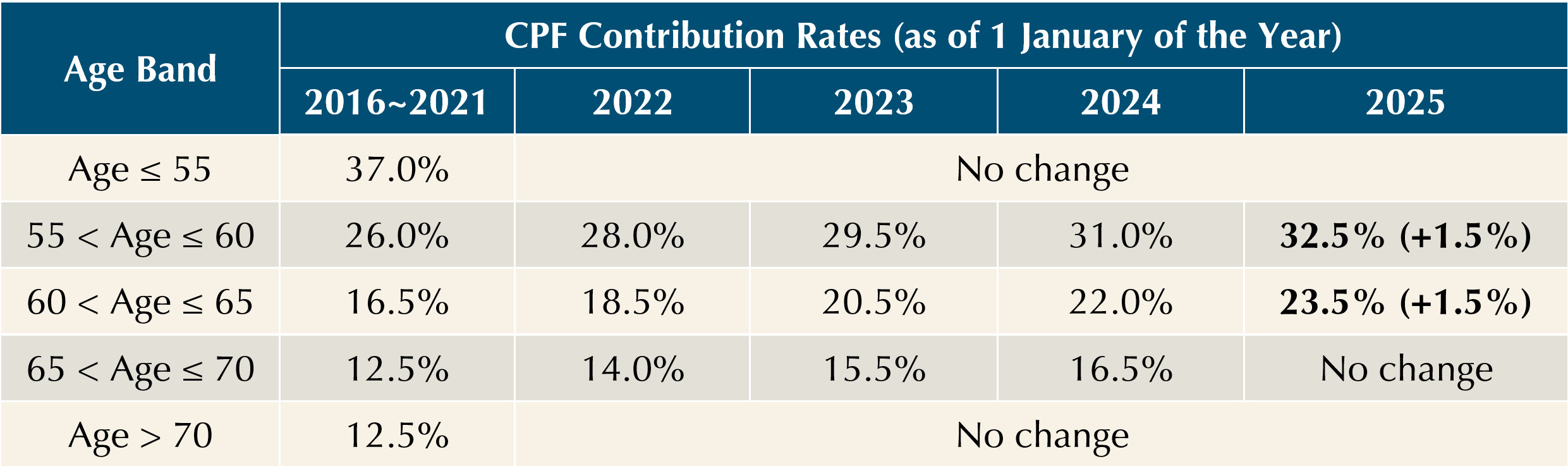

a. Increase in CPF Contribution Rates for Senior Workers [Ongoing]

The government will continue to raise CPF contribution rates for senior workers aged above 55 to 70 from 1 January 2025, with employer contributions to be raised by +0.5% and employee contributions by +1.0%, a +1.5% increase in total.

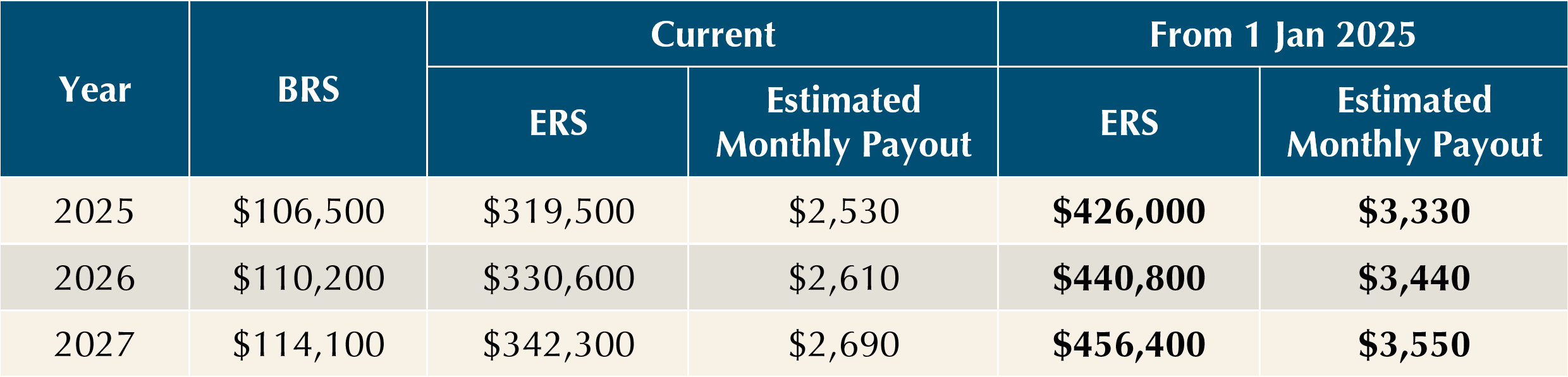

b. Increase in Enhanced Retirement Sum (ERS) [Ongoing]

The government will raise the ERS from three times to four times the Basic Retirement Sum (BRS) from 1 January 2025. This will allow CPF members to make more voluntary top-ups to their CPF Retirement Account (RA) and receive higher CPF LIFE monthly payouts.

c. Closure of CPF Special Account (SA) for Members Aged 55 and Above [One-Time]

The government examined the current 2 CPF accounts that hold savings intended for retirement payouts for members aged 55 and above: the CPF SA and RA. Both SA and RA savings earn the same long-term interest rate, but SA savings can be withdrawn on demand from age 55 if RA savings has met the cohort Full Retirement Sum (FRS).

As a principle, only savings that cannot be withdrawn on demand should earn the long-term interest rate, and savings that can be withdrawn on demand should earn the short-term interest rate. To better align CPF interest rates to the nature of CPF savings in each CPF account, the government will close the SA for members aged 55 and above from early 2025.

When the SA is closed, SA savings will be transferred to the RA up to the cohort FRS, which will continue to earn the long-term interest rate. Any remaining SA savings will be transferred to the Ordinary Account (OA), where they remain withdrawable and will earn the short-term interest rate.

After the SA is closed, members can choose to transfer their OA savings to their RA at any time, up to the prevailing ERS. Once transferred to the RA, the RA savings will earn the long-term interest rate and will be committed towards higher CPF LIFE payouts.

Impact on CPF contributions:

The portion of CPF contributions allocated to the SA will go to the RA instead. If the RA has reached FRS, the excess over FRS will go to the OA.

Impact on CPF Investment Scheme for SA (CPFIS-SA):

Members can continue to stay invested in their CPFIS-SA investment. Once the investments are sold, the proceeds will first go towards making the cohort FRS in the RA, and the excess over FRS will go to the OA.

d. Enhancements to Silver Support Scheme (SSS) [Ongoing]

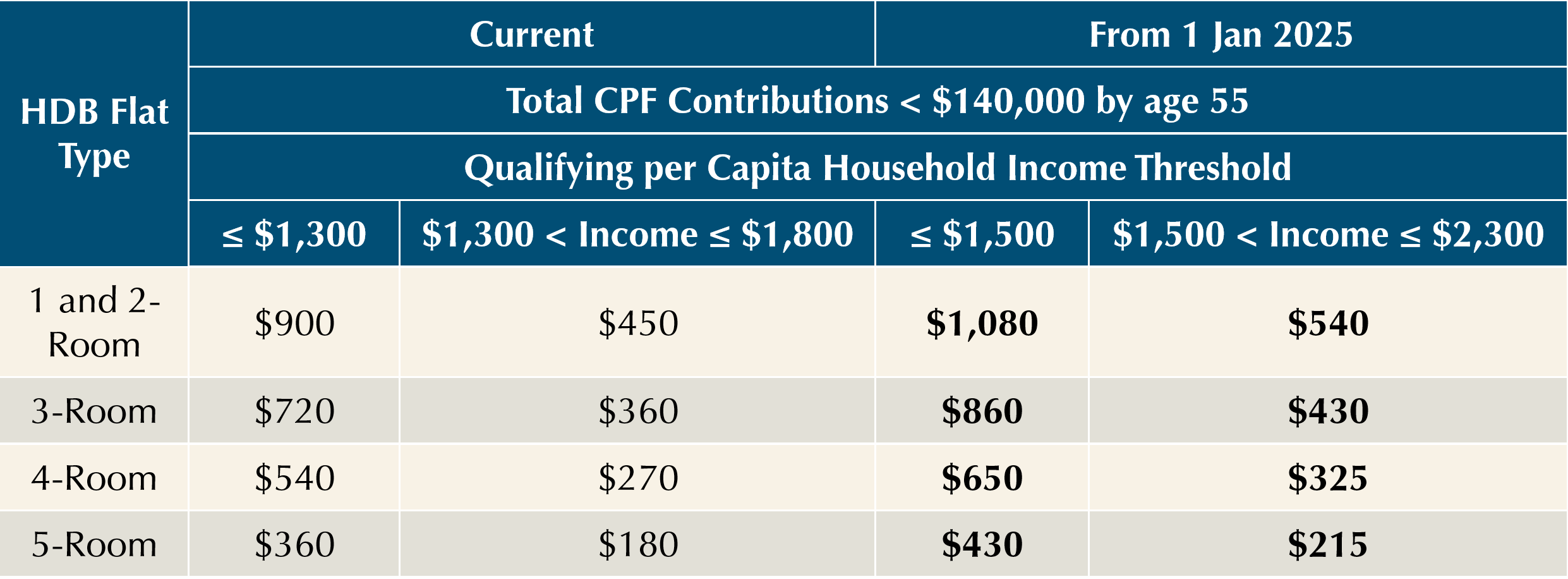

The government will raise the qualifying per capita household income threshold to $2,300 and increase the quarterly payment by 20% for Singaporeans aged 65 and above who had low incomes during their working years and have less family support.

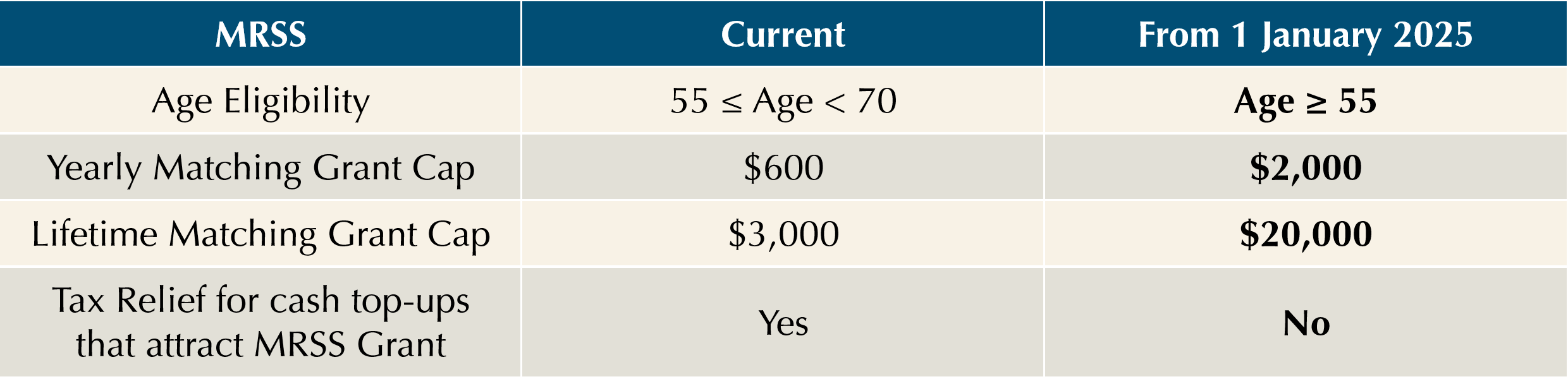

e. Enhancements to the Matched Retirement Savings Scheme (MRSS) [Ongoing]

The government will continue the MRSS beyond the current pilot, expand the age eligibility and increase the matching grant cap from 1 January 2025. With the increase in matching grant already a significant benefit extended by the government, the tax relief will be removed from the cash top-ups that attract the MRSS matching grant.

f. Majulah Package for Young Seniors and above

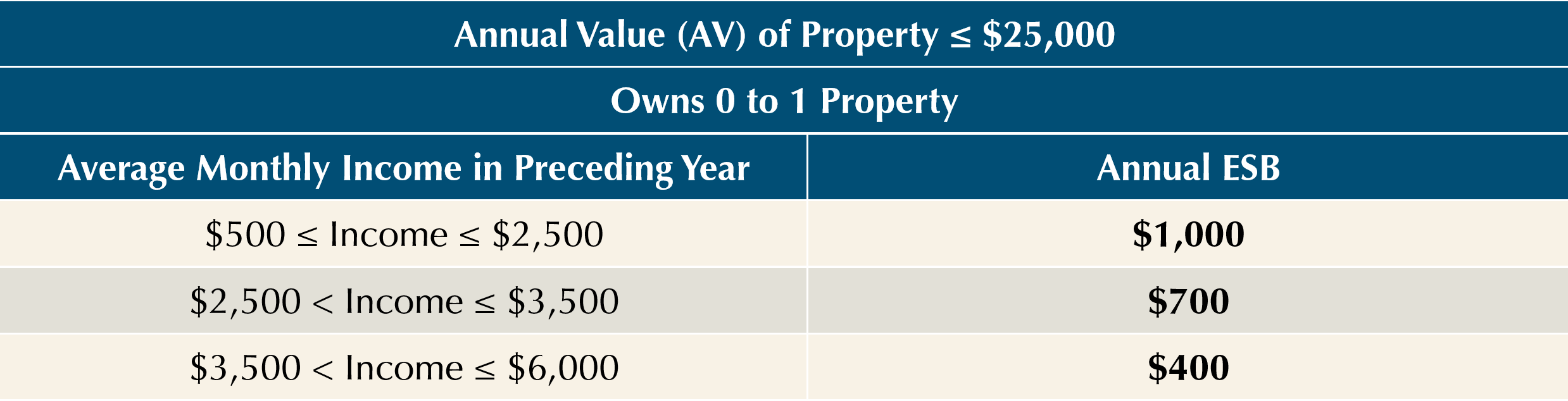

i. Earn and Save Bonus (ESB) [Yearly]

All eligible working Singaporeans born in 1973 or earlier will receive the ESB yearly in their RA or SA. The first annual ESB payout will be made in March 2025.

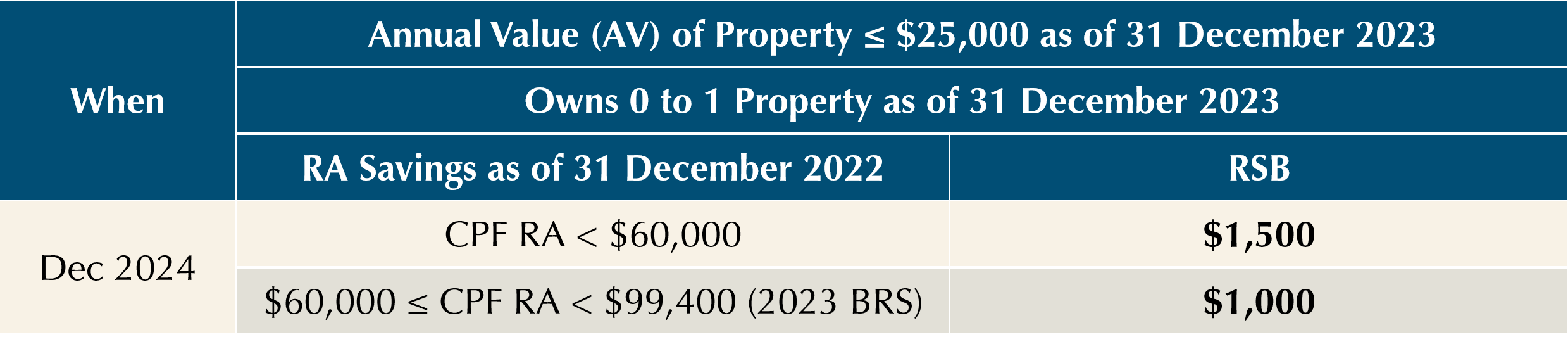

ii. Retirement Savings Bonus (RSB) [One-Time]

All eligible Singaporeans born in 1973 or earlier will receive the RBS in their RA or SA in December 2024.

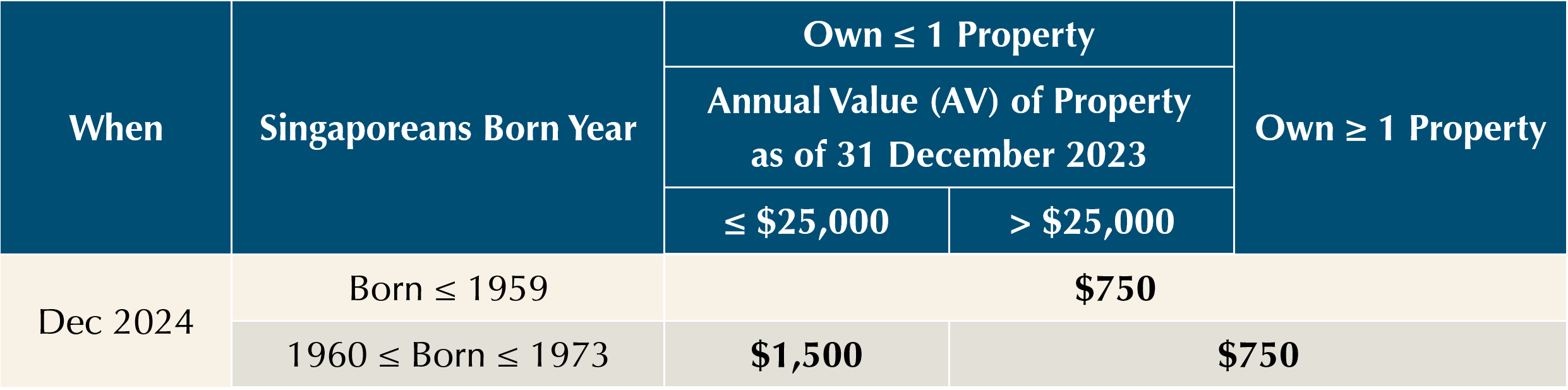

iii. MediSave Bonus (MSB) [One-Time]

All eligible Singaporeans born in 1973 or earlier will receive the MSB in their CPF MediSave Account (MA) in December 2024.

Keeping Healthcare Affordable and Accessible for All

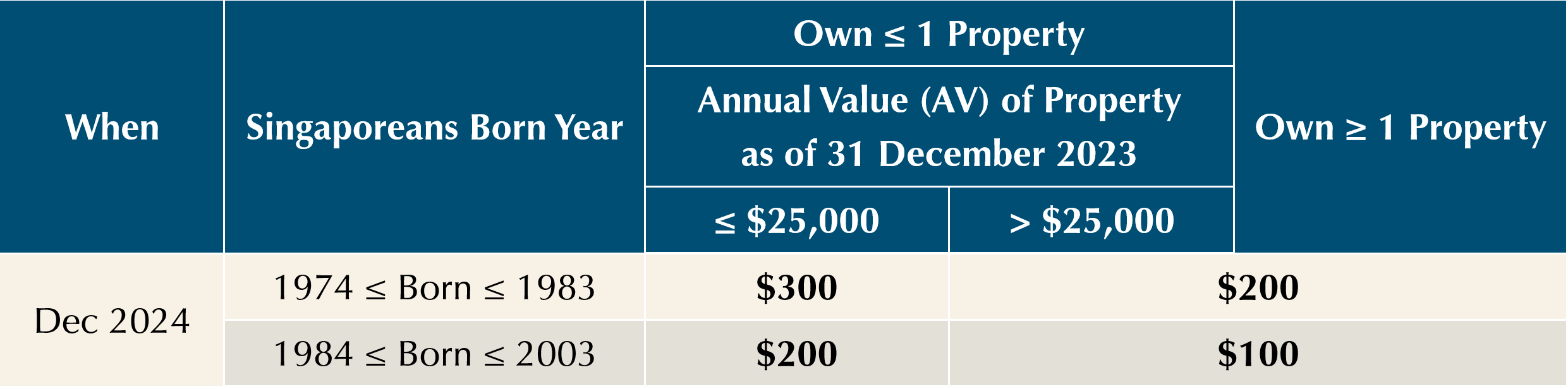

a. MediSave Bonus for Members Aged 21 to 50 [One-Time]

All eligible Singaporeans born between 1974 and 2003 will receive the MediSave Bonus in their MA in December 2024.

Tax Changes

a. Personal Income Tax (PIT) Rebate for Year of Assessment (YA) 2024 [One-Time]

All tax resident individuals will be granted a PIT Rebate of 50% of tax payable for YA 2024, capped at $200 per taxpayer.

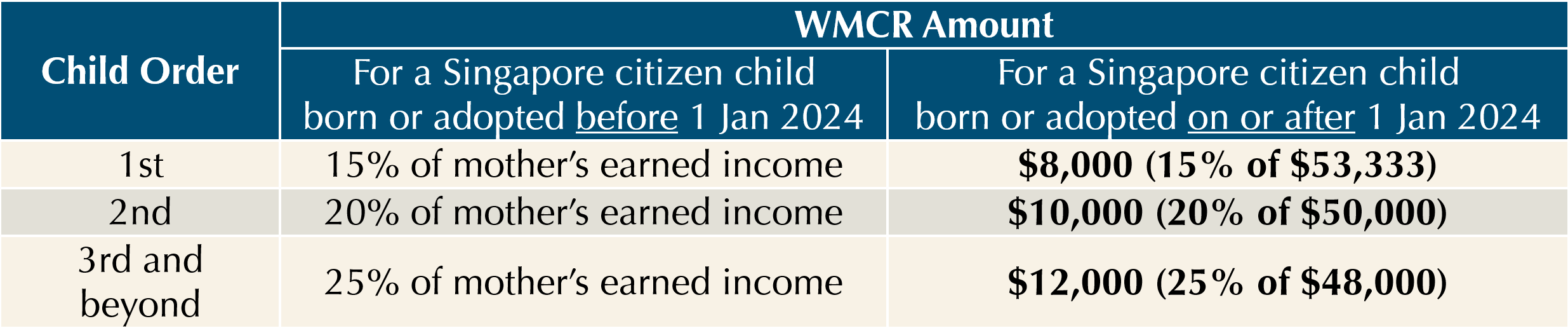

b. Raise Dependant’s or Caregiver’s Income Threshold for Dependant-Related Reliefs [Recurring]

The government will increase the annual income threshold for dependant-related reliefs from $4,000 to $8,000 with effect from YA 2025.

The dependant-related reliefs are:

- Spouse Relief

- Parent Relief

- Qualifying Child Relief

- Working Mother’s Child Relief

- CPF Cash Top-up Relief for top-up to the CPF account of spouse or siblings

- Grandparent Caregiver Relief

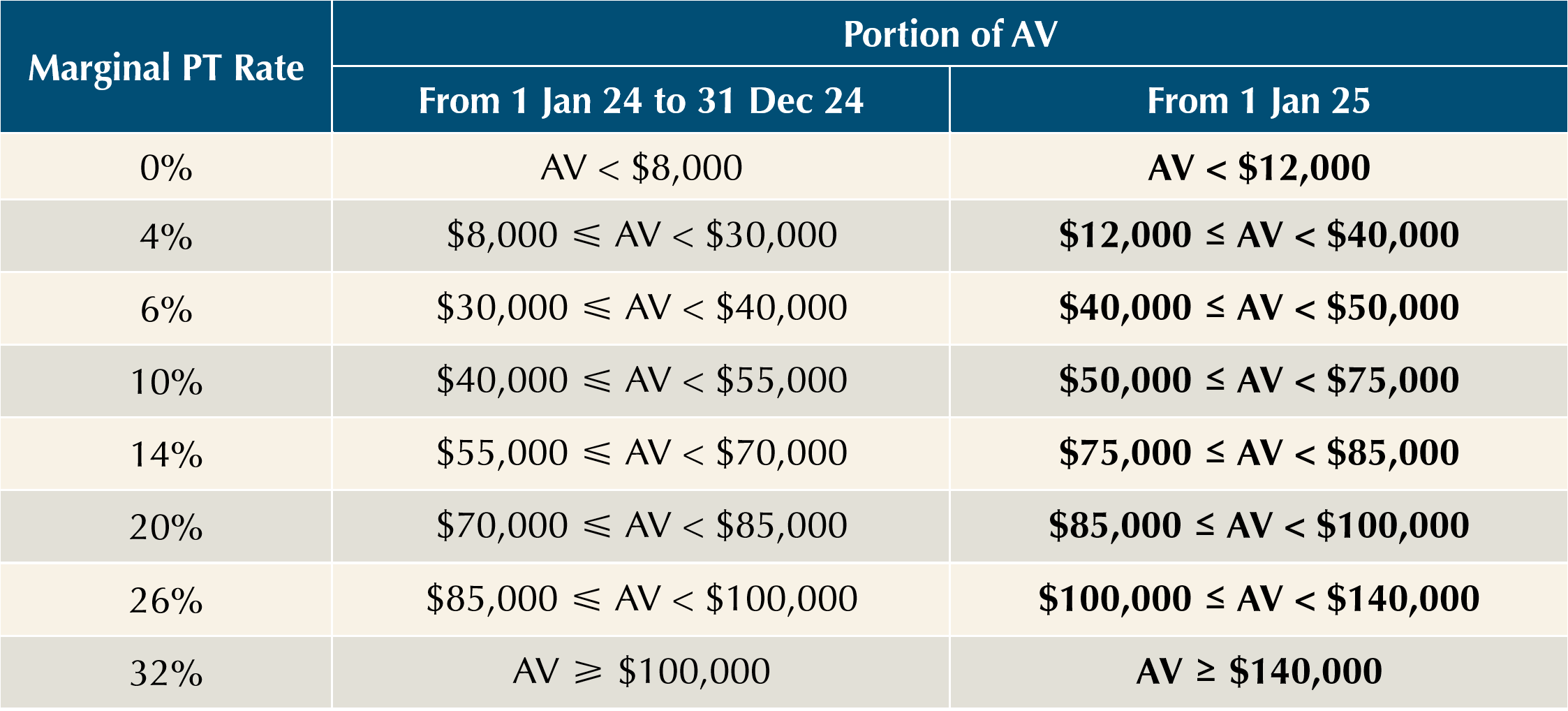

c. Revision of Annual Value (AV) Bands for Owner-Occupied Residential Property Tax (PT) Rates [Recurring]

In view of the sharp rise in AVs over the last two years, the boundaries of the AV bands of the owner-occupied residential PT will be adjusted upwards from 1 January 2025.

d. New Additional Buyer’s Stamp Duty (ABSD) Concession for Single Singapore Citizen (SC) Seniors [Recurring]

The government will extend an ABSD concession to single SC aged 55 and above who wish to right-size their residential property (RP). These seniors will be able to claim a refund of ABSD paid on their replacement private property if they sell their first property within six months after purchasing a lower-value replacement private property. This extension will take effect from 16 February 2024.

Ending Remarks

The above is a highlight of various measures in the Budget 2024 that have a direct impact on personal finance. This budget should bring cheer to many Singaporeans in terms of providing financial support to cope with the rising cost of living, improving employability, strengthening retirement adequacy, and enjoying higher tax savings.

The most surprising change announced in the budget is the closure of CPF SA for members aged 55 and above from early 2025. This change affects those who use SA as a withdrawable high-interest risk-free retirement savings account after setting aside FRS in their RA.

But this move is made in the right spirit as it aligns with the principle of “higher interest rates with a longer lock-in period account”. To compensate for the closure of the high-interest SA, the increase of ERS to 4 times BRS gives affected members an option to move their SA savings into RA, and continue enjoying the high interest rate with a longer lock-in period.

The details of the measures can be found on the Ministry of Finance (MOF) budget website and other relevant government websites. The links to these websites are given at the end of this article for your reference.

Warmest regards,

Solutions Team

Reference Links

MOF Singapore Budget Website:

https://www.mof.gov.sg/singaporebudget

FY2024 Singapore Budget Statement:

https://www.mof.gov.sg/singaporebudget/budget-2024/budget-statement

FY2024 Singapore Budget Speech Video:

https://www.mof.gov.sg/singaporebudget/about-budget/videos

FY2024 Singapore Budget Booklet:

https://www.mof.gov.sg/singaporebudget/resources/budget-booklet

FY2024 Singapore Budget Infographics:

https://www.mof.gov.sg/singaporebudget/resources/budget-infographics

FY2024 Singapore Budget Support for Households:

https://www.mof.gov.sg/singaporebudget/resources/support-for-households

Singapore Budget Support Calculator:

https://supportgowhere.life.gov.sg/budget/support-calculator

Assurance Package (AP) Scheme:

https://govbenefits.gov.sg/

Community Development Council (CDC) Voucher Scheme:

https://vouchers.cdc.gov.sg/

GST Voucher (GSTV) Scheme:

https://www.gstvoucher.gov.sg/

Forward Singapore (ForwardSG):

https://www.forwardsingapore.gov.sg/

CPF Budget Highlights 2024:

https://www.cpf.gov.sg/member/infohub/news/cpf-related-announcements/budget-highlights-2024